December Labor-Market Update

US labor-market numbers for December 2023 are in. There are no changes from November. Tightness remains at 1.4 and efficient unemployment remains at 4.4%.

The US labor-market numbers for December 2023 just came out. This post uses the latest numbers on vacant jobs and unemployed workers from the Bureau of Labor Statistics to compute three key statistics:

Labor-market tightness

Efficient unemployment rate

Unemployment gap

The US labor market remains in the exact same position as in November: unemployment rate and vacancy rate remain the same, so labor-market tightness and efficient unemployment are also unchanged. Since nothing is new, this post reviews the numbers very quickly.

New developments

The US labor-market statistics for December 2023 are as follows:

Unemployment rate: u = 3.7%. This is the same as in November.

Vacancy rate: v = 5.2%. This is the same as in November.

Labor-market tightness: v/u = 5.2/3.7 = 1.4. This is the same as in November.

Efficient unemployment rate: u* = √uv = √(0.037 × 0.052) = 4.4%. This is the same as in November.

Unemployment gap: u – u* = 0.037 – 0.044 = –0.7pp. This is the same as in November.

Is the US labor market is too tight or too slack?

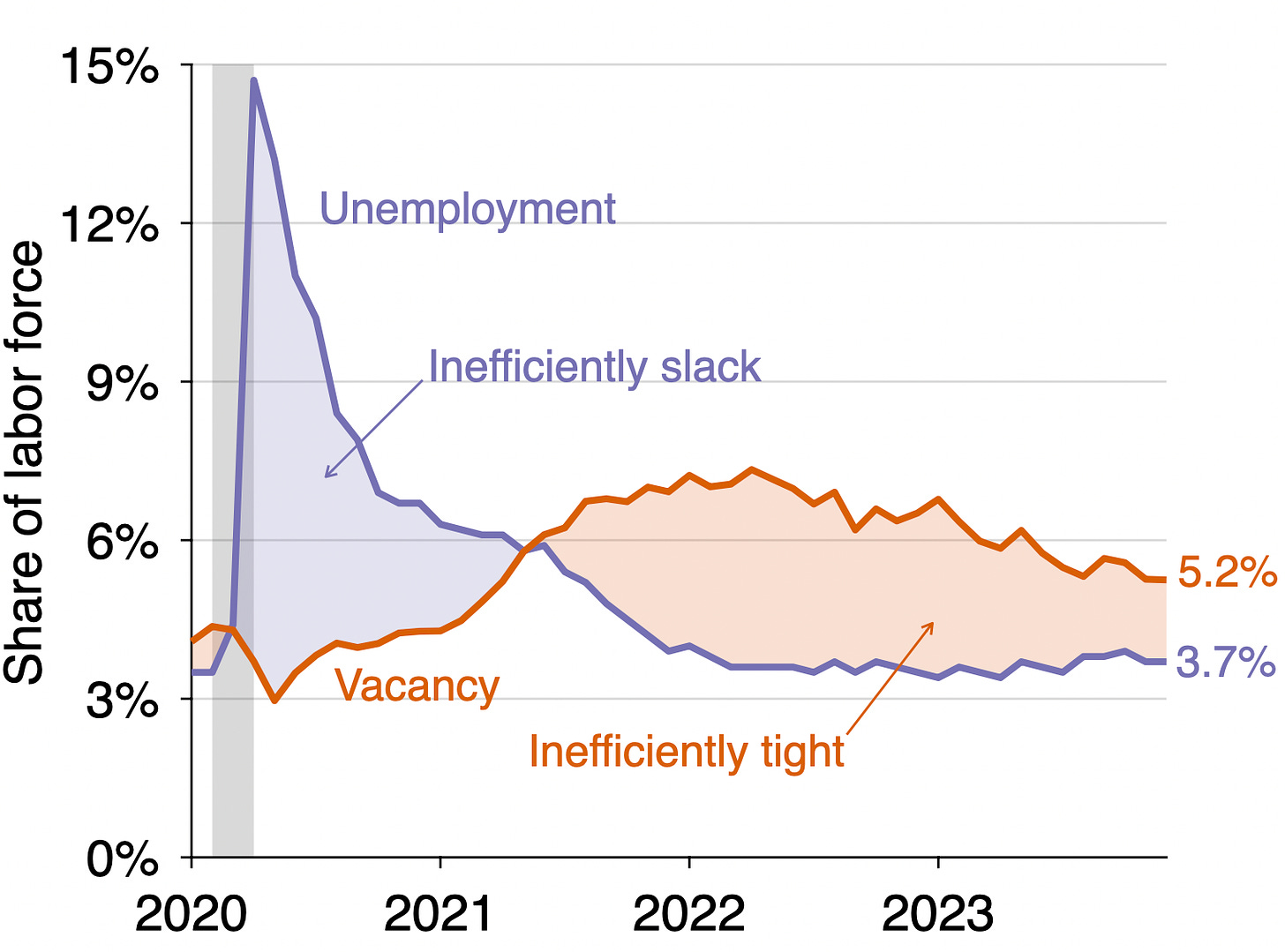

Since the vacancy rate is above the unemployment rate (5.2% > 3.7%), the US labor market remains inefficiently tight. This means that the labor market is above full employment: the labor market is so hot that an excessive amount of labor is devoted to recruiting and hiring instead of producing.1 The labor market has been inefficiently tight since May 2021:

We can also see that the US labor market is inefficiently tight by looking at labor-market tightness v/u. Tightness remains above unity (1.4 > 1):

How far is unemployment from its efficient rate?

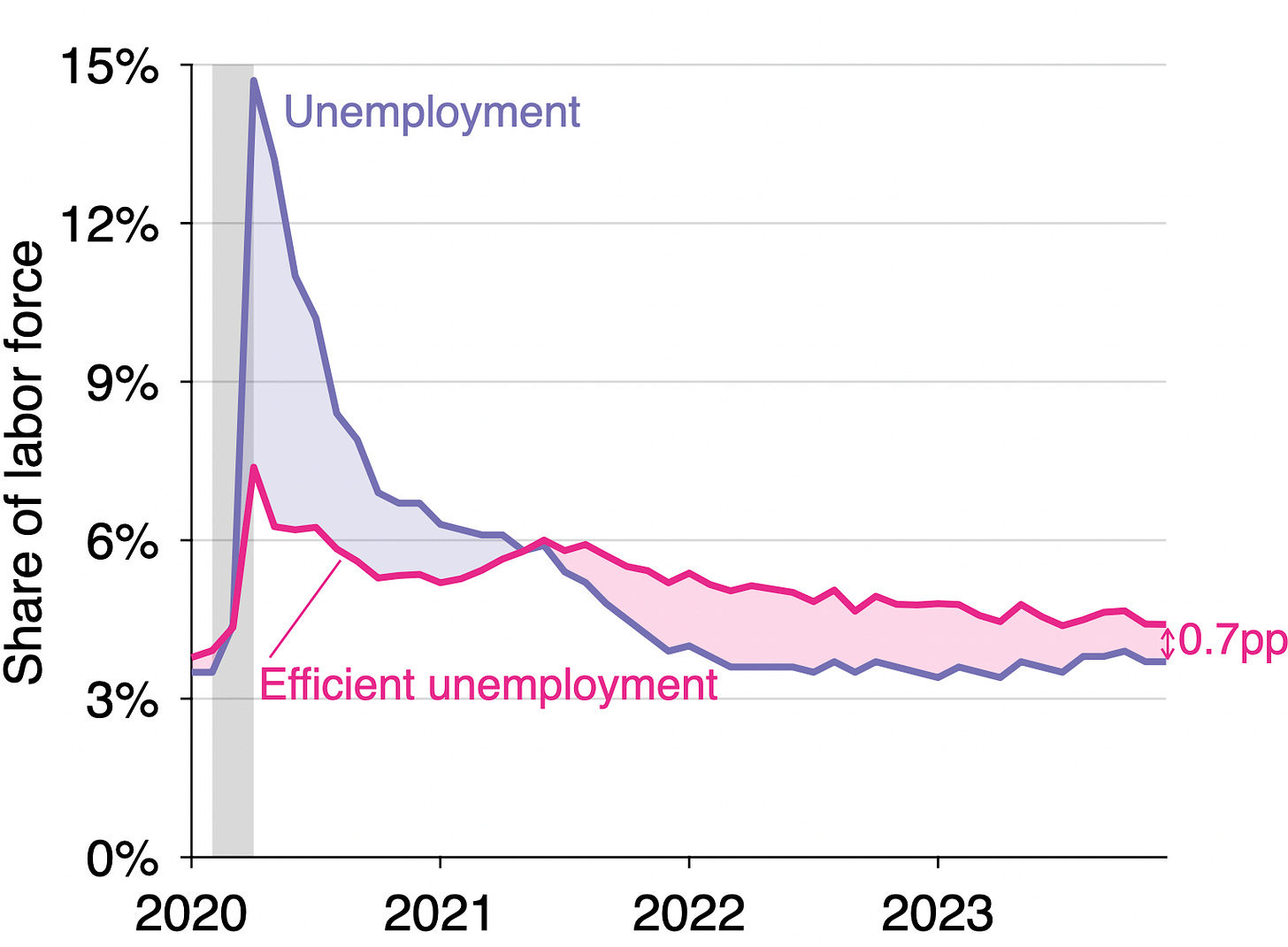

Tightness remains above 1, so the labor market is still inefficiently tight. This means that the actual unemployment rate remains below the efficient unemployment rate. The graph below illustrates the construction of the efficient unemployment rate:

The efficient unemployment rate is 0.7 percentage point above the actual unemployment rate (u* = 4.4% while u = 3.7%). This negative unemployment gap is another manifestation of an inefficiently tight labor market. Below is the evolution of the unemployment gap over the course of the pandemic. The unemployment gap has been negative (u* > u) since the middle of 2021:

What is happening to the Beveridge curve?

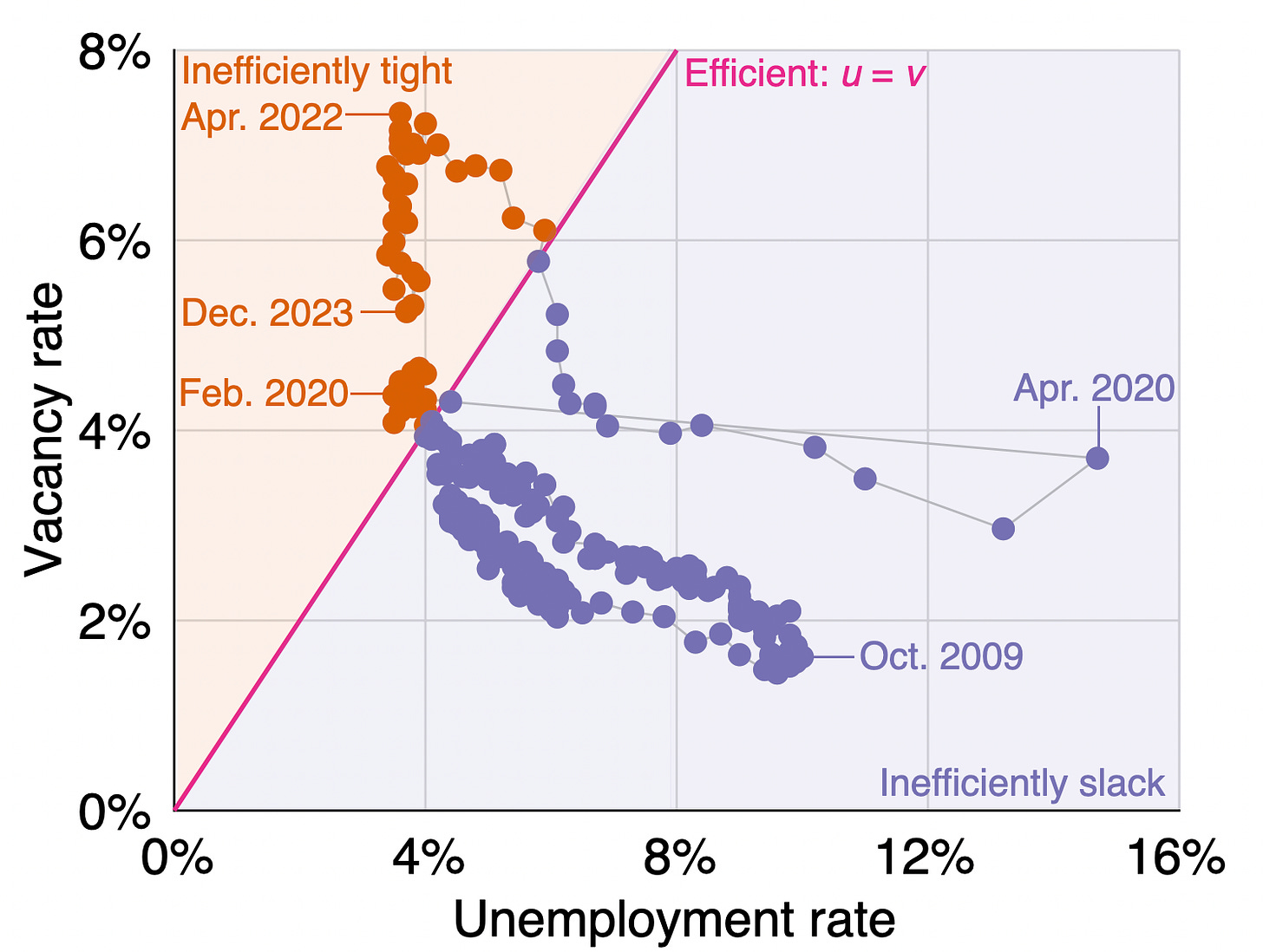

The Beveridge curve shifted dramatically outward at the onset of the pandemic. Since April 2022, however, the Beveridge curve has been slowly shifting back inward to its pre-pandemic location. Historically, such shifts do not occur very often. But the curve is now well between its pre-pandemic and pandemic locations:

Background for readers just joining us: data

The number of unemployed workers is measured by the Current Population Survey (CPS). The CPS is a household survey conducted on the Sunday–Saturday week including the 12th of the month. The CPS also reports the number of labor-force participants.

The number of vacant jobs is measured by the Job Openings and Labor Turnover Survey (JOLTS). The JOLTS is a firm survey conducted on the last business day of the month. The JOLTS release is dated November 2023, but because vacancies are measured on the last business day of November, I assign them to December 2023.

The numbers from the CPS and JOLTS then give unemployment and vacancy rates:

Unemployment rate = # unemployed workers / # labor-force participants

Vacancy rate = # vacant jobs / # labor-force participants

Background for readers just joining us: methodology

The formula u* = √uv for the efficient unemployment rate is derived in a recent paper that Emmanuel Saez and I wrote. The paper shows that under simple but realistic assumptions, the efficient unemployment rate is the geometric average of the unemployment and vacancy rates—that is, u* = √uv.

An implication of this formula is that the labor market is efficient whenever there are as many unemployed workers as vacant jobs (u = v); inefficiently tight whenever there are fewer unemployed workers than vacant jobs (u < v); and inefficiently slack whenever there are more unemployed workers than vacant jobs (u > v). This criterion can also be formulated using labor-market tightness v/u.

Resources for the job-market season

It is job-market season in Economics. Job talks are starting this week and will be going on for the next two months. If you are a job candidate, you have now polished the content of your presentation. But it might be helpful to revisit how your slides are formatted—to make sure that they are as clean and easily readable as possible.

You have done all the hard work. It would be a shame if your message did not go through just because your slides are cluttered, the text font is too large or too small, the color scheme is distracting, or your mathematical expressions are unreadable.

Last year, I wrote a post summarizing best practices on slide design and sharing a LaTeX template for academic presentations that follows these best practices. I have continued to develop the template in the past year. The most recent version is freely available on GitHub. I have also updated and developed the list of best practices. The most up-to-date version is available on my website.

Note that this definition of efficiency and full employment has nothing to do with inflation: it is only about the appropriate allocation of resources on the labor market.