The US Labor-Market Tightness Remains Unchanged in April

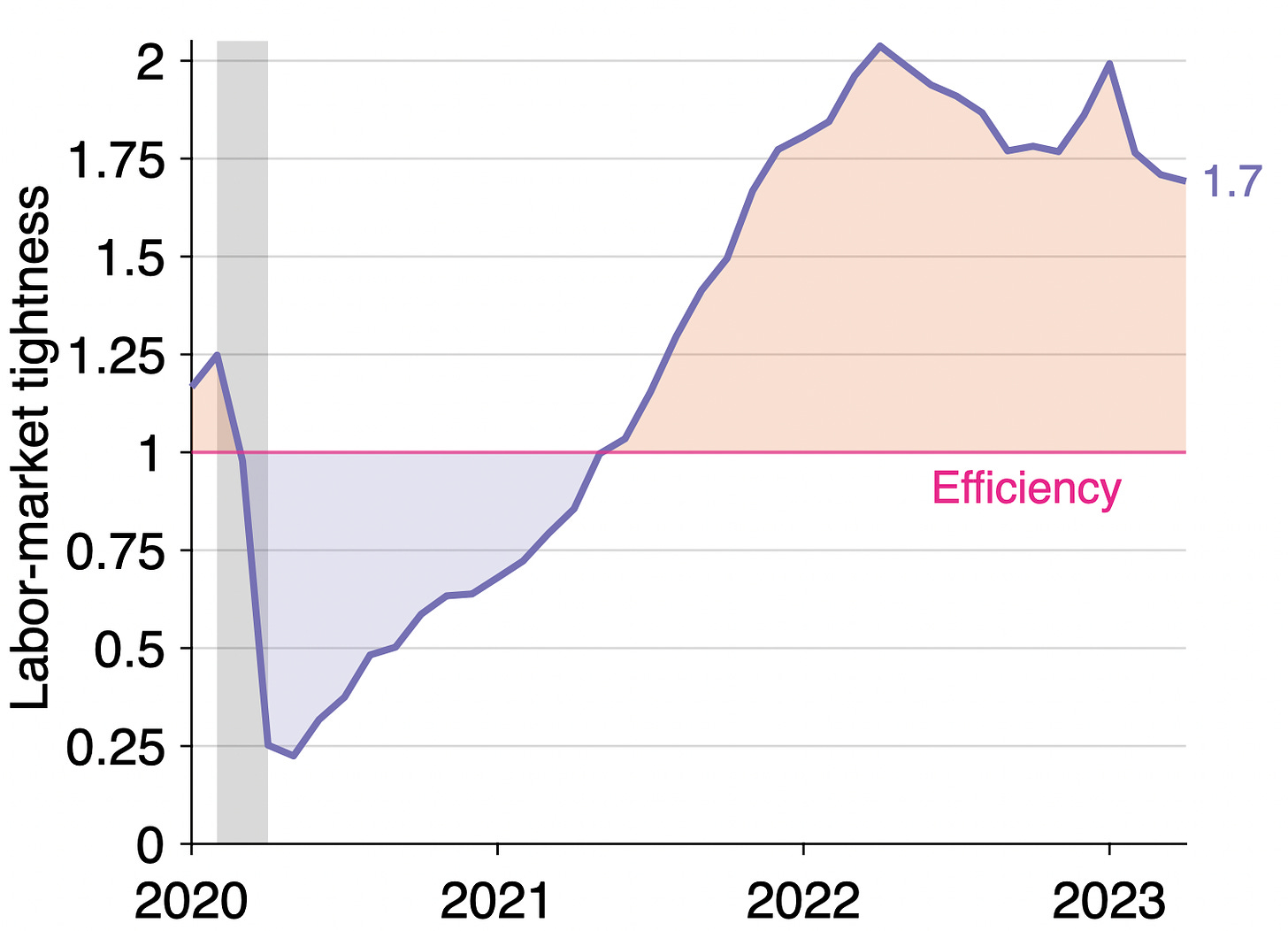

The US labor-market tightness remained at 1.7 in April 2023—still above its efficient level of 1.

This week the US Bureau of Labor Statistics (BLS) reported the numbers of vacant jobs and unemployed workers in the United States in April 2023. This post reviews the numbers and uses them to compute labor-market tightness, efficient unemployment rate, and unemployment gap. It also discusses the Beveridge curve and monetary policy.

Where do the numbers come from?

The number of vacant jobs is measured by the Job Openings and Labor Turnover Survey (JOLTS).1 The number of unemployed workers is measured by the Current Population Survey (CPS).2 The CPS also reports the number of labor-force participants. These numbers then give unemployment and vacancy rates:

Unemployment rate = # unemployed workers / # labor-force participants

Vacancy rate = # vacant jobs / # labor-force participants

What are this month’s numbers?

The numbers for April 2023 are the following:

Unemployment rate: u = 3.4%. This is down from 3.5% in March 2023.

Vacancy rate: v = 5.8%. This is down from 6.0% in March 2023.

Labor-market tightness: v/u = 1.7. This is the same as in March 2023.

Is the US labor market too tight or too slack?

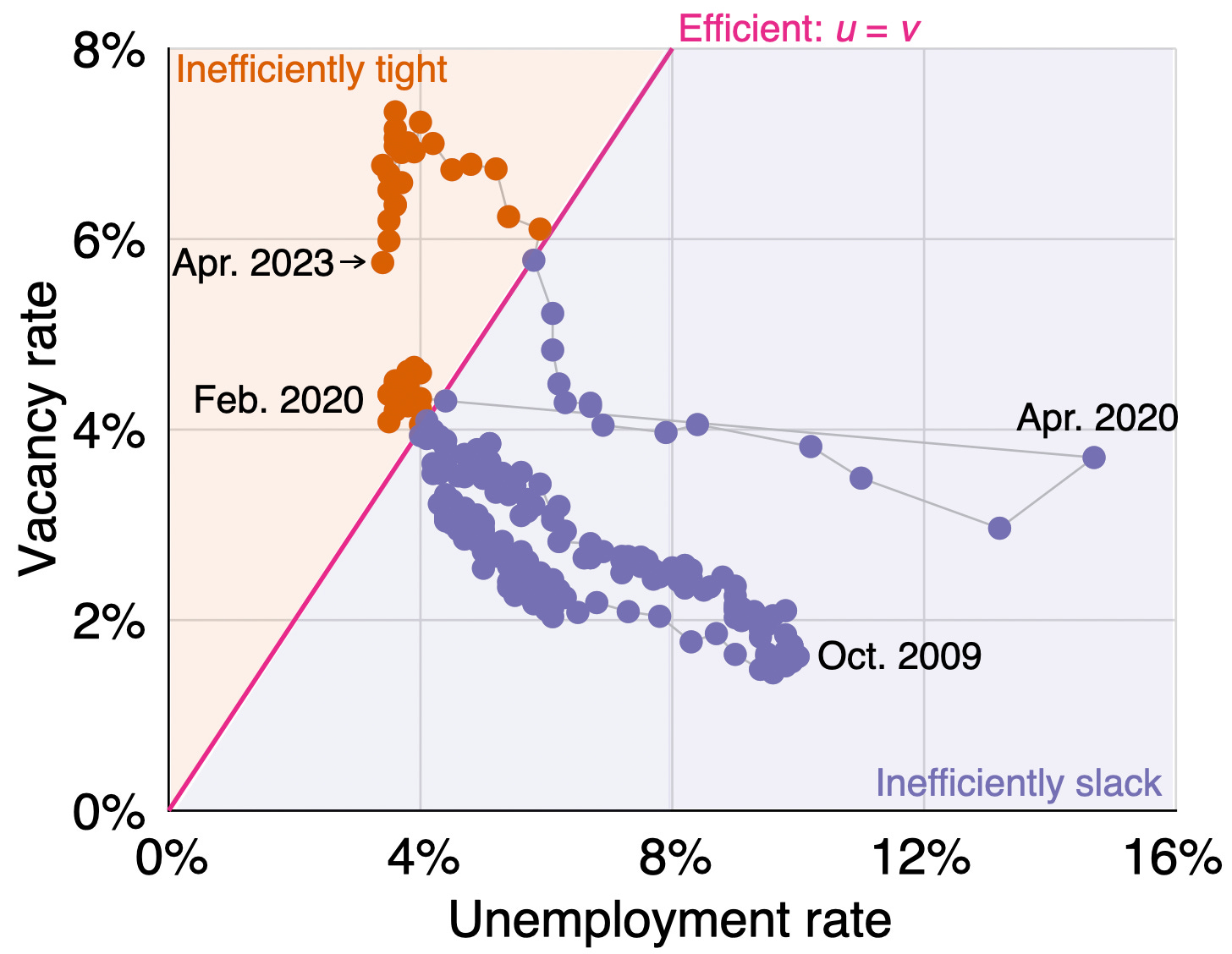

As Emmanuel Saez and I show in a recent paper, the labor market is efficient whenever there are as many unemployed workers as vacant jobs; inefficiently tight whenever there are fewer unemployed workers than vacant jobs; and inefficiently slack whenever there are more unemployed workers than vacant jobs.

Since the vacancy rate is well above the unemployment rate (5.8% > 3.4%), the US labor market remains inefficiently tight. The labor market has been inefficiently tight since May 2021, as illustrated below:

Another way to see that the labor market is inefficiently tight is that labor-market tightness v/u remains above unity (1.7 > 1). Labor-market tightness had been falling from May 2022, when it peaked at 2.0, to November 2022, when it reached 1.8. Tightness rose again in December 2022 and January 2023, climbing back to 2.0. So it looked like the labor market was picking up steam again at the end of 2022, despite the tightening of monetary policy. But from February 2023 to April 2023, the labor market has been cooling. Tightness is now down to 1.7.

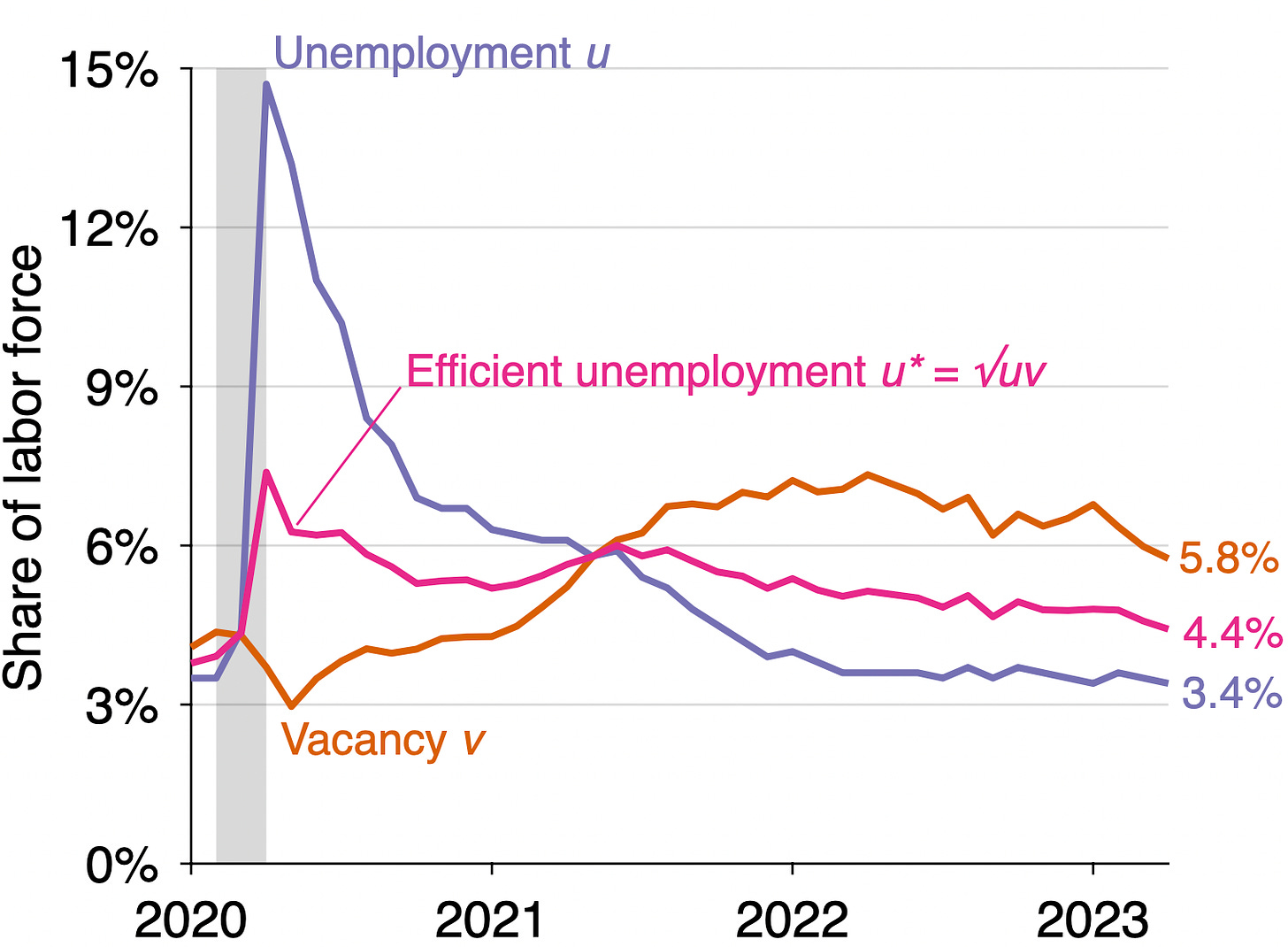

How far is unemployment from its efficient rate?

The labor market moved closer to efficiency, but it is still inefficiently tight. To see how far from efficiency the labor market remains, let’s compute the efficient unemployment rate. The efficient unemployment rate is given by u* = √uv, as Emmanuel and I show in the same recent paper. Accordingly, the unemployment gap is given by u - u* = u - √uv. We therefore have the following numbers for April 2023:

Efficient unemployment rate: u* = √uv = √(0.034 × 0.058) = 4.4%. This is down from 4.6% in March 2023.

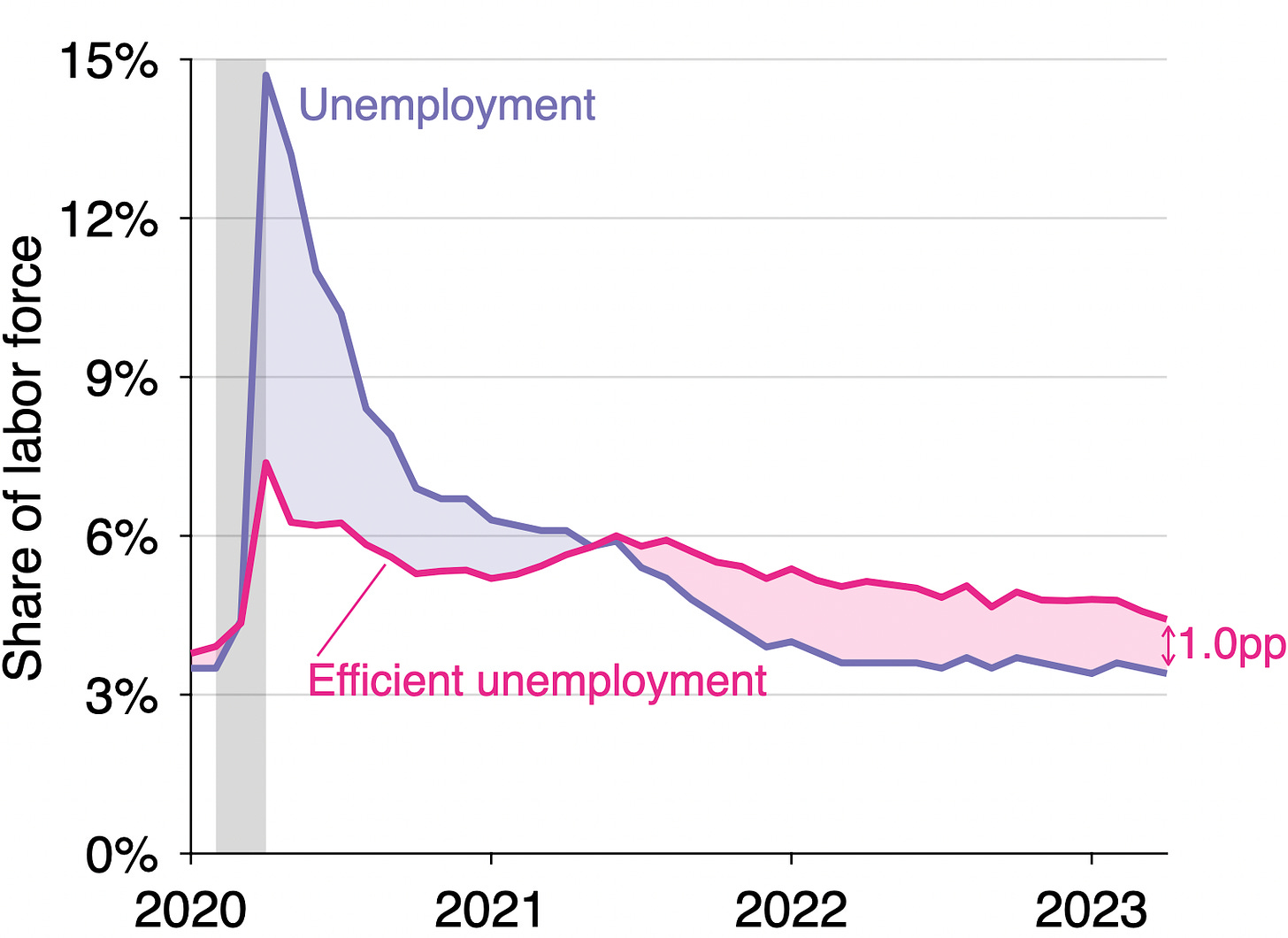

Unemployment gap: u – u* = 0.034 – 0.044 = –1.0pp. The gap narrowed from –1.1pp in March 2023.

The construction of the efficient unemployment rate is illustrated below:

Here is the evolution of the unemployment gap over the course of the pandemic:

What do the numbers imply for monetary policy?

One of the mandates of monetary policy is to maintain the economy at full employment. Although the law does not specify what full employment is, it is natural to interpret it as the socially efficient level of employment. In that case, one of the goals of monetary policy would be to maintain employment and unemployment at their efficient rates.

Unemployment is currently below its efficient rate, so it seems that monetary policy should continue to tighten to cool aggregate demand and labor demand—just as the Fed decided to do this week. The monetary multiplier is around 0.5: when the Fed raises the federal funds rate by 1 percentage point, the unemployment rate increases by 0.5 percentage point. The current unemployment gap is -1.0pp, so the Fed should raise the fed funds rate by an additional 1.0/0.5 = 2.0pp to eliminate the gap.

However, monetary policy takes time to affect the economy. It takes about 1.5 years for a change in the fed funds rate to fully take effect. In the past year and a half, the Fed has raised the fed funds rate by 5pp. Only a fraction of that increase has taken effect. The rest might be enough to bring the unemployment rate to its efficient level. Indeed, given a monetary multiplier of 0.5, we would expect such an increase in interest rates to raise the unemployment rate by 5 × 0.5 = 2.5pp.

The unemployment gap in mid-2022, when the Fed started tightening, was -1.6pp. Assuming that aggregate demand has been stable since, we would expect the unemployment gap to turn positive once monetary policy has been fully absorbed, at -1.6 + 2.5 = 0.9pp. Under this basic scenario, the current monetary tightening would therefore be strong enough to bring the labor market to efficiency—and maybe even to the inefficient slack territory.

Of course, this recommendation does not take into account inflation. This is purely to improve the allocation of labor between producing, recruiting, and jobseeking. The fact that inflation is still above 2% might give the Fed another reason to raise rates.

What is happening to the Beveridge curve?

The Fed has has often said that it does not expect the unemployment rate to increase much once the economy has stabilized—staying below 4%, just as it was before the pandemic when labor-market tightness was at 1.

However, as the the Fed tightens monetary policy, the labor market moves along a downward-sloping Beveridge curve. As labor-market tightness falls, the unemployment rate necessarily increases. And since the Beveridge curve shifted dramatically outward during the pandemic, it is not possible to come back to the same tightness and same unemployment rate as before the pandemic. With this curve, either tightness will be higher than before the pandemic, or the unemployment rate will be higher.

For a “soft landing” to occur, the Beveridge curve must shift back inward to its pre-pandemic location. The curve is currently in-between its pre-pandemic and pandemic locations. In fact, the curve has been moving back inward over the past few months—including in April. So let’s keep an eye on the curve in the next few months to see whether a soft landing materializes:

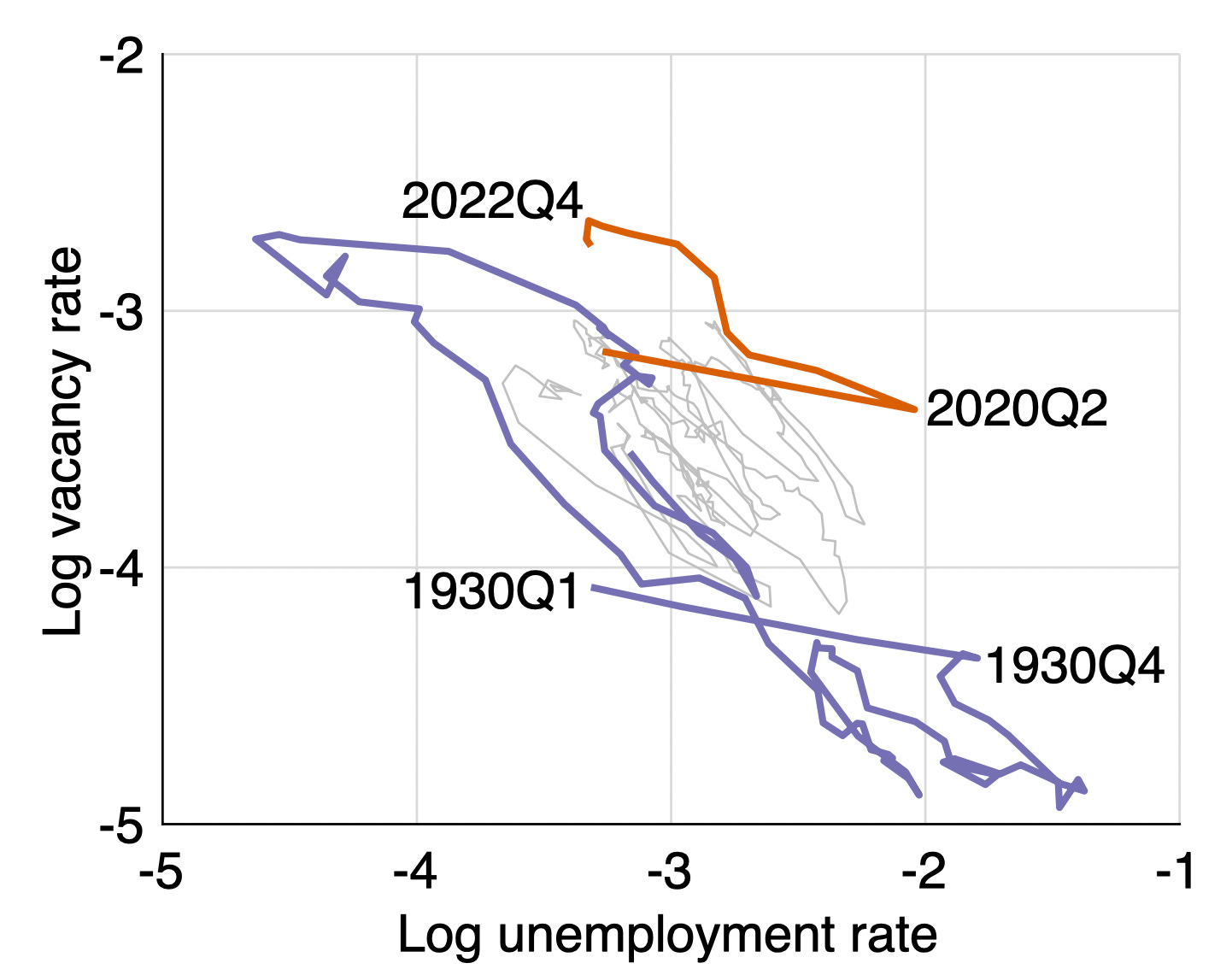

The shift in the Beveridge curve that followed the pandemic is truly exceptional. The only time in US recorded history that the Beveridge curve shifted out so much is right after the Great Depression. All other shifts are much, much smaller:

In the above graph, the orange line is the pandemic period: 2020–2022. The purple line is the Great Depression and World War 2 period: 1930–1950. The gray line is the postwar period: 1951–2019. The data come from our “u*=√uv” paper.

The JOLTS is a firm survey conducted on the last business day of the month. The JOLTS release is dated March 2023, but because vacancies are measured on the last business day of March, I assign them to April 2023.

The CPS is a household survey conducted on the Sunday–Saturday week including the 12th of the month.

Hi Pascal,

Regarding the need for unemployment to rise, I think there’s good reasons no to think so, both having to do with non-linearities. One in the Phillips Curve in the just release Benigno-Eggertson paper (where you probably consulted), the other in the Beveridge curve, discussed in this great Twitter thread by Simon Mongey. This thread also challenges the notion of a shifting out of the BC recently.

https://twitter.com/simon_mongey/status/1590705225161408512?s=21&t=aMBhh3gK7weGIUdfICGsLQ

Appreciate the insights (and the forecast/assessment regarding restrictiveness of monetary policy).

Regarding the u/v measure - I've been wondering about two things:

1. Regarding v - there is some anecdotal evidence of 'fake' job postings to look stronger than the company actually is;

2. Regarding u - there is about 4.5 mln out of labor force folk who say they'd want a job. Now I haven't investigated the historical trend (i.e. maybe this is a standard number) but if there is now a shift of people going for out of labor force directly to employment, what would the complication be for measuring tightness? Of course it would mean there is more slack - but I'm wondering of how big this channel could theoretically be (i.e. is unemployment under counted by 100k or by 1mln)