The US Labor Market Continues to Tighten Along a Stable Beveridge Curve

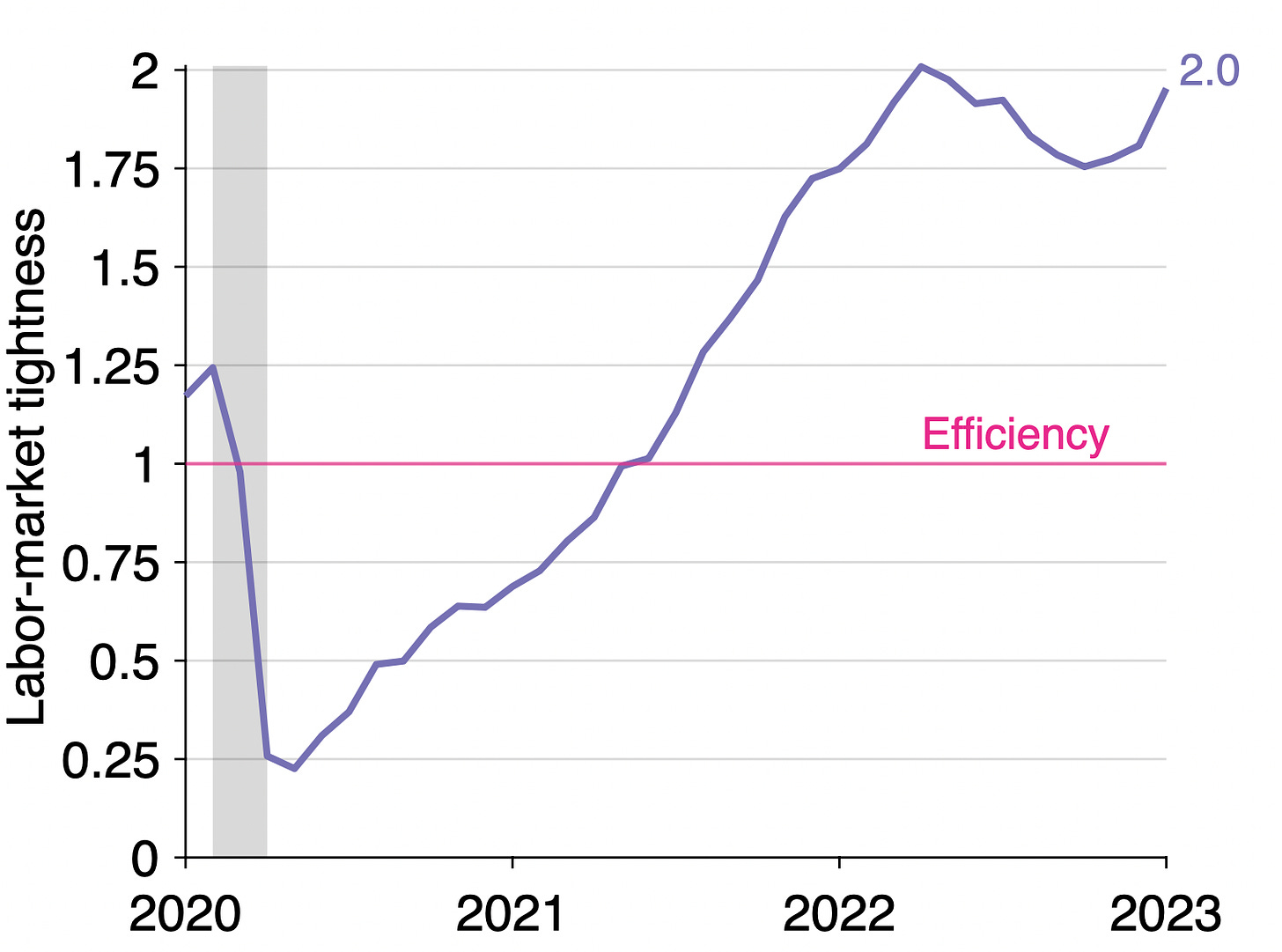

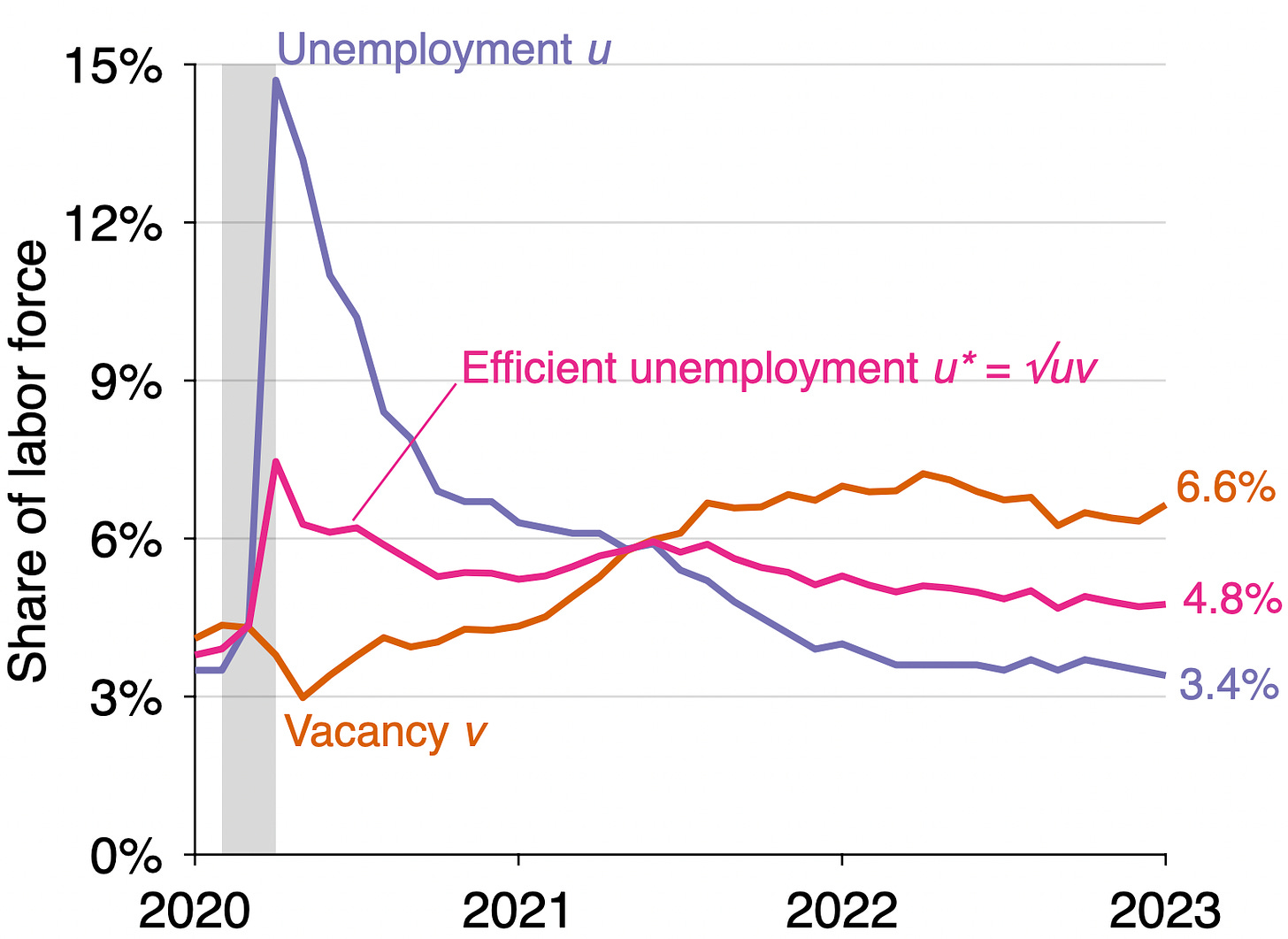

In January 2023, labor-market tightness has returned to 2.0 while the efficient unemployment rate is stable at 4.8%.

The Bureau of Labor Statistics (BLS) has just released the numbers of vacant jobs and unemployed workers in the United States in January 2023. This post reviews the numbers and uses them to compute labor-market tightness, the efficient unemployment rate, and the unemployment gap. We will also look at the Beveridge curve and discuss some implications for monetary policy.

Where do the numbers come from?

The number of vacant jobs is measured by the Job Openings and Labor Turnover Survey (JOLTS).1 The number of unemployed workers is measured by the Current Population Survey (CPS).2 The CPS also reports the number of labor-force participants. These numbers then give unemployment and vacancy rates:

Unemployment rate = # unemployed workers / # labor-force participants

Vacancy rate = # vacant jobs / # labor-force participants

What are this month’s numbers?

The numbers for January 2023 are the following:

Unemployment rate: u = 3.4%. This is down from 3.5% in December 2022.

Vacancy rate: v = 6.6%. This is up from 6.3% in December 2022.

Labor-market tightness: v/u = 2.0. This is up from 1.8 in December 2022.

Is the US labor market too hot or too cold?

In a recent paper, Emmanuel Saez and I show that the labor market is efficient whenever u = v, inefficiently tight whenever u < v, and inefficiently slack whenever u > v.

Since the vacancy rate remains above the unemployment rate (6.6% > 3.4%), the US labor market remains inefficiently tight. The labor market has been inefficiently tight since May 2021, as illustrated in the graph below:

Another way to see that the labor market is inefficiently tight is that labor-market tightness v/u remains above unity (2.0 > 1).

The interesting development is that the labor market continued to tighten in January. Labor-market tightness had been falling from May 2022, when it peaked at 2.0, to November 2022, when it reached 1.7. But labor-market tightness increased again in December 2022, from 1.7 to 1.8, and then again this month, from 1.8 to 2.0. So it looks like the labor market is picking up steam again—despite the tightening of monetary policy that started in May 2022. This reversal is quite surprising.

How far is unemployment from its efficient level?

The labor market tightened and moved away from efficiency in January 2023. To see how far from efficiency the labor market currently is, let’s compute the efficient unemployment rate and unemployment gap in January 2023, using the formula from the same recent paper. These numbers tell us the current distance from efficiency:

Efficient unemployment rate: u* = √uv = 4.8%. This is up from 4.7% in December 2023.

Unemployment gap: u – u* = –1.4pp. The gap has widened from –1.2pp in December 2022.

The construction of the efficient unemployment rate is illustrated below:

The evolution of the unemployment gap is illustrated below:

What does this imply for monetary policy?

One of the mandates of monetary policy is to maintain the economy at full employment. If we interpret full employment as the socially desirable level of employment—which seems like a natural interpretation, and which also aligns theory with practice—then monetary policy should try to maintain the unemployment gap at zero.

The unemployment gap is currently negative, so monetary policy should tighten to cool aggregate demand and labor demand. A median estimate of the monetary multiplier is 0.5, which means that when the Fed raises the federal funds rate by 1 percentage point, the unemployment rate increases by 0.5 percentage points. The current unemployment gap is -1.4pp, so the Fed should raise the fed funds rate by 1.4/0.5 = 2.8pp to eliminate the gap.

Of course there are complications. First, the monetary multiplier is not measured very accurately, so there is some uncertainty around the 2.8.3 Second, monetary policy takes time to affect the economy. It takes about 1.5 years for a change in the fed funds rate to fully take effect (see figure 2 in Coibion 2012). In the past year, the Fed has raised the fed funds rate from 0% to 4.5%. Only a fraction of that increase has taken effect. The rest may be enough to bring the unemployment rate to its efficient level.

What is happening to the Beveridge curve?

The Fed has has often said that it does not expect the unemployment rate to increase much once the economy has stabilized. At the same time, we have just seen that the goal of the Fed is to bring the unemployment rate to its efficient level, which currently is 4.8%. For such “soft landing” to occur, it must therefore be that the efficient unemployment rate falls down to 3.5% or 4%—so the unemployment gap can be closed without a higher unemployment rate.

The efficient unemployment rate was around 4% just before the pandemic, so this might seem like a reasonable expectation. However, the efficient unemployment rate is determined by the location of the Beveridge curve, and the curve is not where it was before the pandemic. The curve has shifted dramatically outward during the pandemic:

For the efficient unemployment rate to come down to its pre-pandemic level, the Beveridge curve will have to shift back inward to its pre-pandemic location. Otherwise the efficient unemployment rate wil remain at its current level. The curve remains much further outward than before the pandemic, as the above graph shows, and there is currently no sign that the curve will come back to its pre-pandemic level. But let’s keep an eye on the curve in the next few months to see whether a soft landing will materialize.

The JOLTS is a firm survey conducted on the last business day of the month. The JOLTS release is dated December 2022, but because vacancies are measured on the last business day of December, I assign these numbers to January 2023.

The CPS is a household survey conducted on the Sunday–Saturday week including the 12th of the month.

This is because monetary economists have neglected unemployment for a long time, so there are only few studies that estimate the impact of monetary policy on unemployment. The typical focus is on industrial production, GDP, and inflation.