September Labor-Market Update

US labor-market numbers for September are in. Labor-market tightness rose back up to 1.5—from 1.4 in August. The Beveridge curve shifted slightly outwards.

The US labor-market numbers for September 2023 just came out. This post uses the latest numbers on vacant jobs and unemployed workers from the Bureau of Labor Statistics to compute three key statistics:

Labor-market tightness

Efficient unemployment rate

Unemployment gap

Overall, the US labor market tightened slightly in September. So the labor market remains inefficiently tight. The Beveridge curve shifted slightly outwards, raising the efficient unemployment rate.

New developments

The US labor-market statistics for September 2023 are as follows:

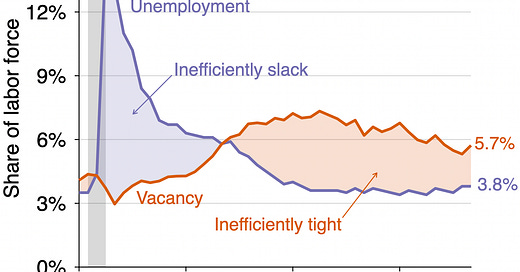

Unemployment rate: u = 3.8%. This is the same as in August.

Vacancy rate: v = 5.7%. This is up from 5.3% in August.

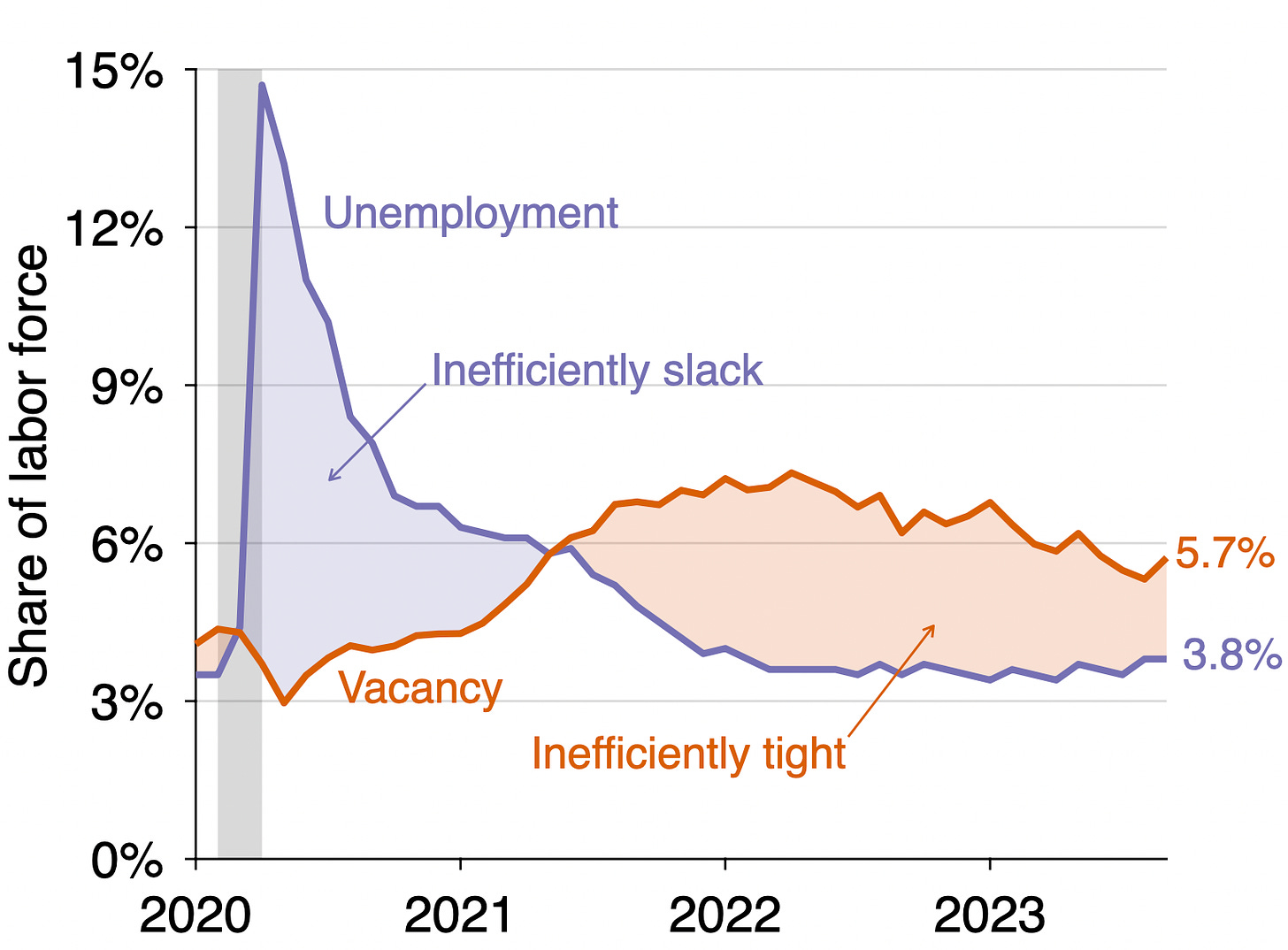

Labor-market tightness: v/u = 5.7/3.8 = 1.5. This is up from 1.4 in August.

Efficient unemployment rate: u* = √uv = √(0.038 × 0.057) = 4.7%. This is up from 4.5% in August.

Unemployment gap: u – u* = 0.038 – 0.047 = –0.9pp. The gap widened from -0.7pp in August.

Is the US labor market is too tight or too slack?

Since the vacancy rate is above the unemployment rate (5.7% > 3.8%), the US labor market remains inefficiently tight. This means that the labor market is above full employment: the labor market is so hot that an excessive amount of labor is devoted to recruiting and hiring instead of producing.1

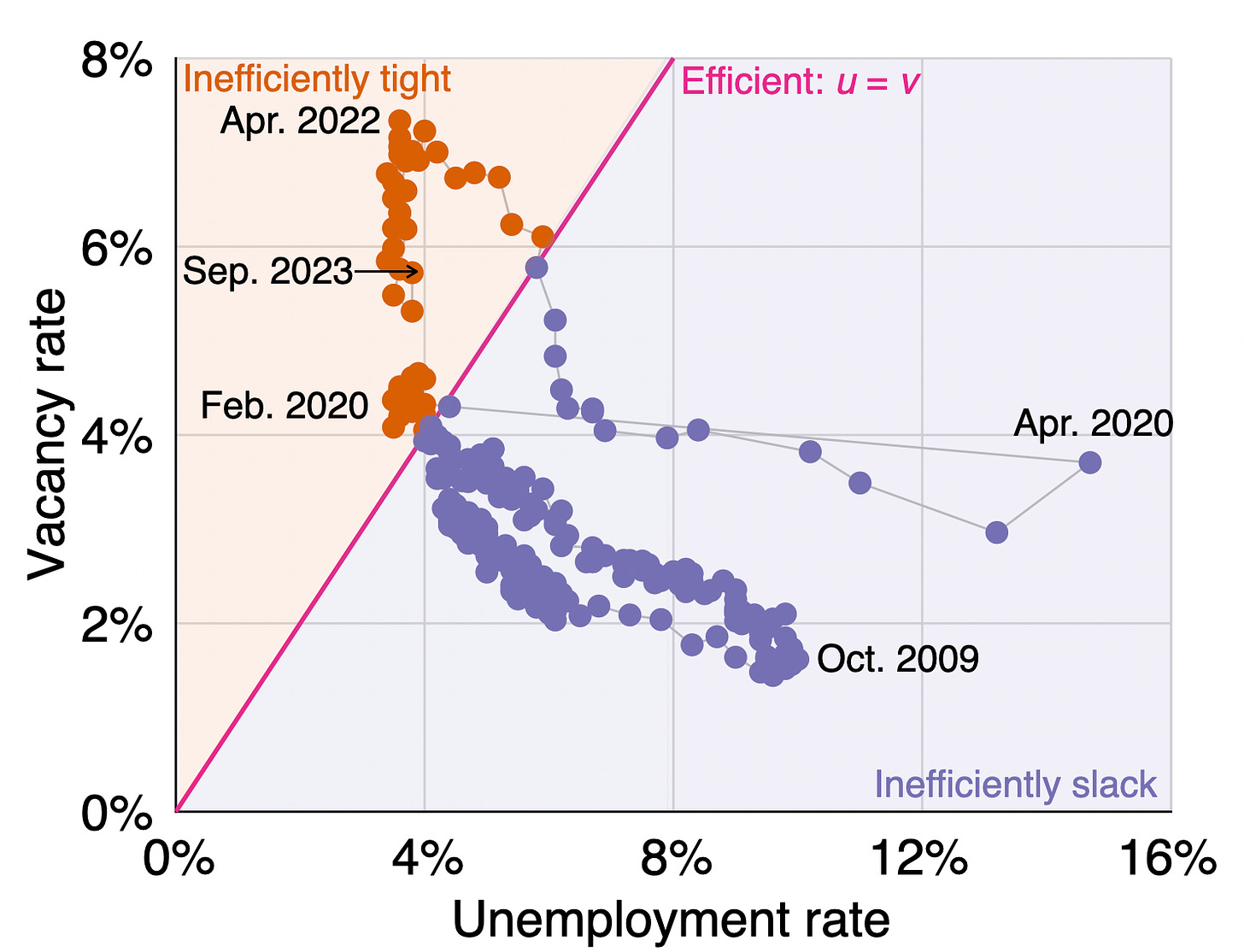

In fact, the labor market has been inefficiently tight since May 2021, as illustrated below:

We can also see that the US labor market is inefficiently tight by looking at labor-market tightness v/u, which remains above unity (1.5 > 1):

As the above graph shows, the labor market has tightened slightly in September, stopping the cooling that had been occurring since April 2022. We will see in the next few months whether this is only a temporary tightening, or whether the labor-market stabilizes around the current level.

How far is unemployment from its efficient rate?

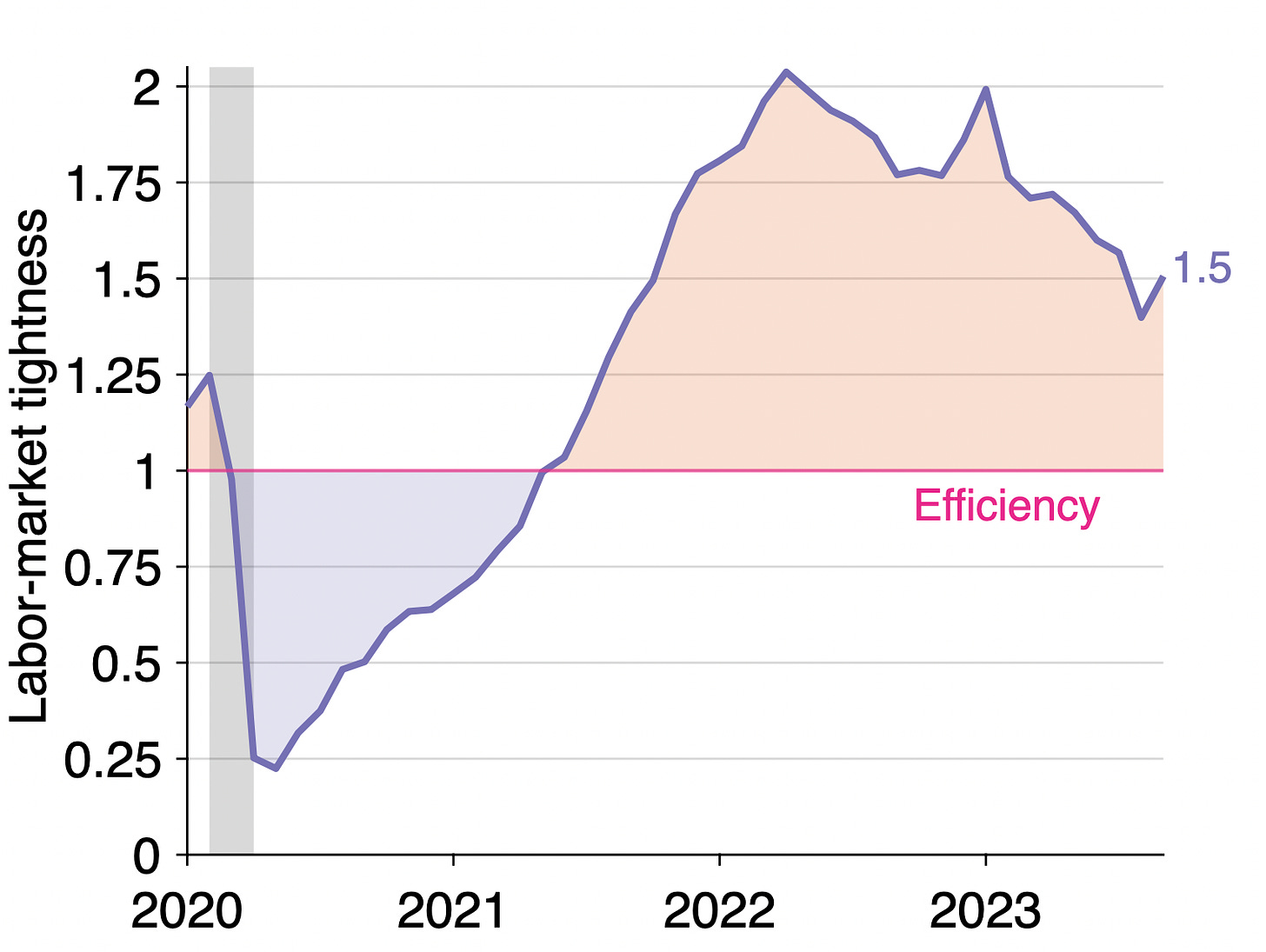

Tightness remains above 1, so the labor market is still inefficiently tight. This means that the actual unemployment rate remains below the efficient unemployment rate. The graph below illustrates the construction of the efficient unemployment rate:

In September the efficient unemployment rate is 0.9 percentage point above the actual unemployment rate (u* = 4.7% while u = 3.8%). This negative unemployment gap is another manifestation of an inefficiently tight labor market.

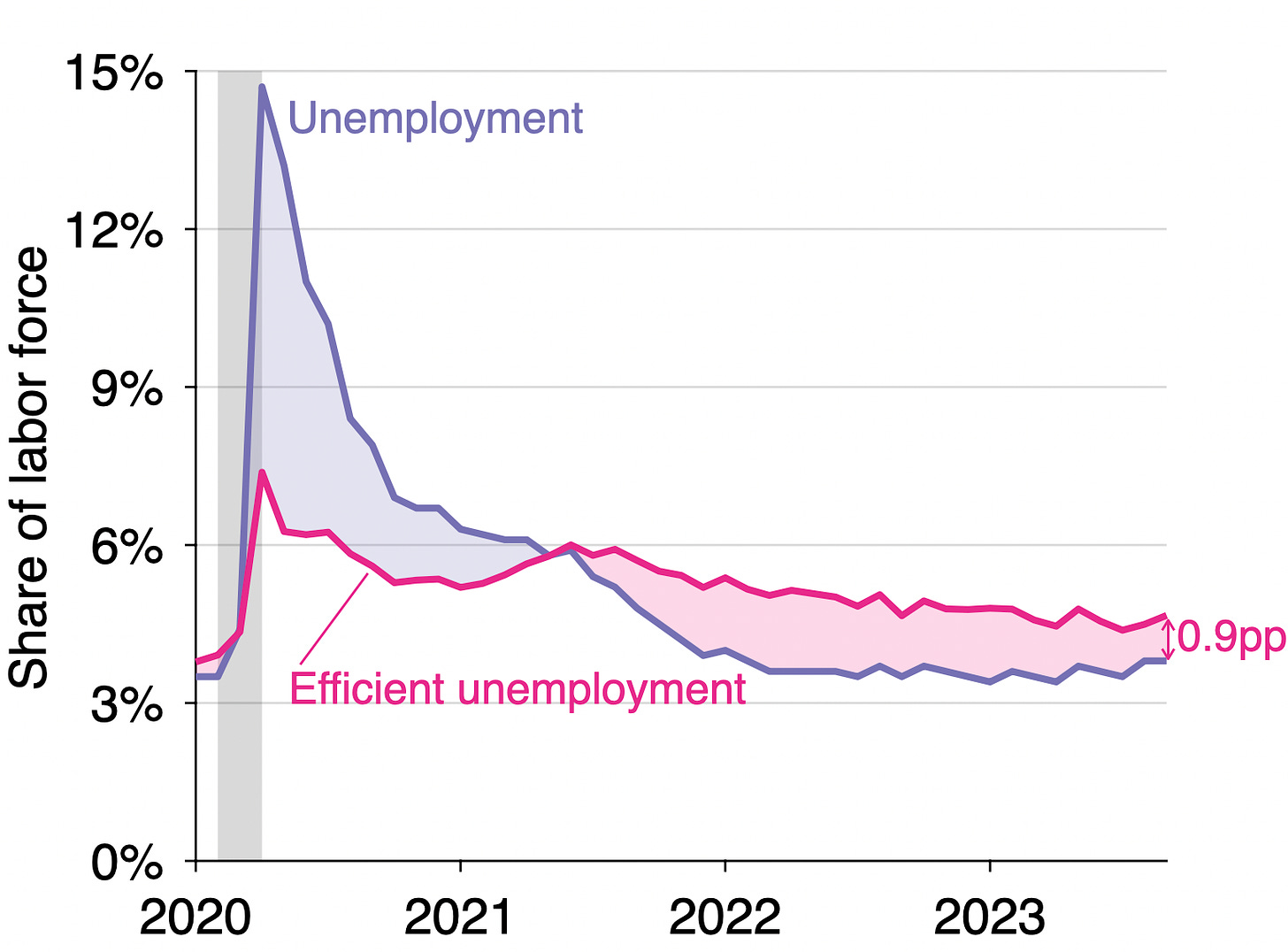

Below is the evolution of the unemployment gap over the course of the pandemic. The unemployment gap has been negative (u* > u) since the middle of 2021:

In fact the unemployment gap widened in September, not because the actual unemployment rate changed, but because the efficient unemployment rate increased slightly (from 4.5% to 4.7%). The gap u - u* is now -0.9pp.

The efficient unemployment rate u* indicates the unemployment rate consistent with full employment. Since one of the mandates of the Federal Reserve is to maintain the economy at full employment, u* is a good target for the Fed. When the actual unemployment rate reaches u*, the Fed knows that it has satisfied its employment mandate. Currently unemployment is below u*, so the labor market needs to cool some more to reach full employment. And since the efficient unemployment rate u* rose in September, the Fed’s target has moved a little further away.

What is happening to the Beveridge curve?

The reason why the efficient unemployment rate rose in September is that the Beveridge curve shifted back out slightly. The Beveridge curve shifted dramatically outward at the onset of the pandemic. Since April 2022, however, the Beveridge curve has been slowly shifting back inward to its pre-pandemic location. Such shifts do not occur very often, but the curve is currently well between its pre-pandemic and pandemic locations.

In September, however, the curve shifted back outward. Below is the current location of the US labor market in the Beveridge diagram:

Background for readers just joining us: data

The number of vacant jobs is measured by the Job Openings and Labor Turnover Survey (JOLTS). The number of unemployed workers is measured by the Current Population Survey (CPS). The CPS also reports the number of labor-force participants. These numbers then give unemployment and vacancy rates:

Unemployment rate = # unemployed workers / # labor-force participants

Vacancy rate = # vacant jobs / # labor-force participants

Background for readers just joining us: methodology

The formula u* = √uv for the efficient unemployment rate is derived in a recent paper that Emmanuel Saez and I wrote. The paper shows that under simple but realistic assumptions, the efficient unemployment rate is the geometric average of the unemployment and vacancy rates—that is, u* = √uv.

An implication of this formula is that the labor market is efficient whenever there are as many unemployed workers as vacant jobs (u = v); inefficiently tight whenever there are fewer unemployed workers than vacant jobs (u < v); and inefficiently slack whenever there are more unemployed workers than vacant jobs (u > v). This criterion can also be formulated using labor-market tightness v/u.

Figure code and template

The figures in this post are updated versions of those in the paper.

The code and data to produce the figures in the paper is available on GitHub: https://github.com/pmichaillat/squareroot-uv/. This repository might be helpful to reproduce our analysis or apply the analysis to other labor markets.

The MATLAB template that I use to plot macroeconomic data is also available on GitHub: https://github.com/pmichaillat/matlab-figures/. The template produces basic time series and scatter plots, such as those in this post. The template is written in MATLAB, but chatGPT should be able to translate it to other languages (it’s very good at coding).

Note that this definition of efficiency and full employment has nothing to do with inflation: it is only about the appropriate allocation of resources on the labor market.

Well explained. Thanks for sharing