Labor-Day Labor-Market Update

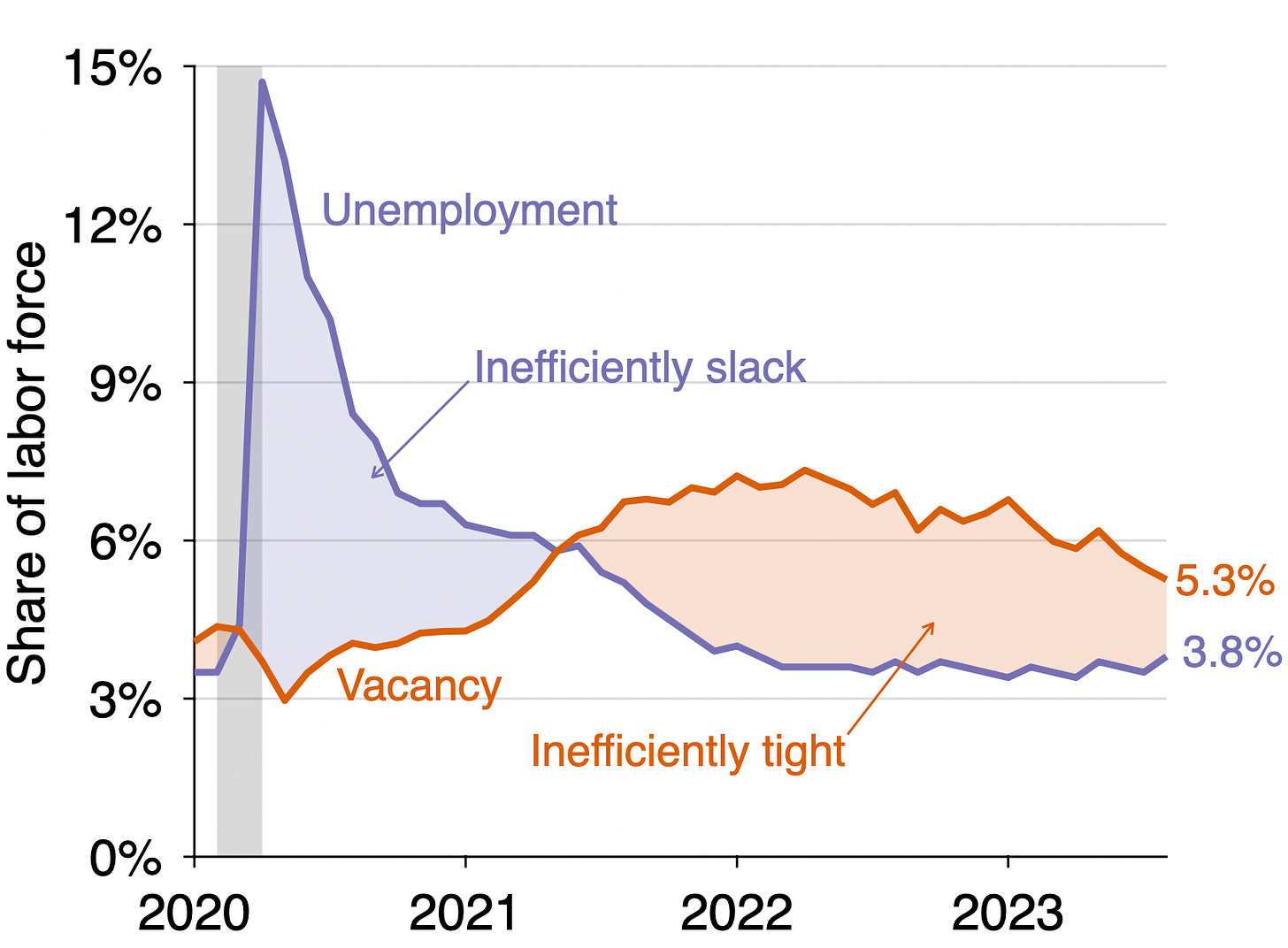

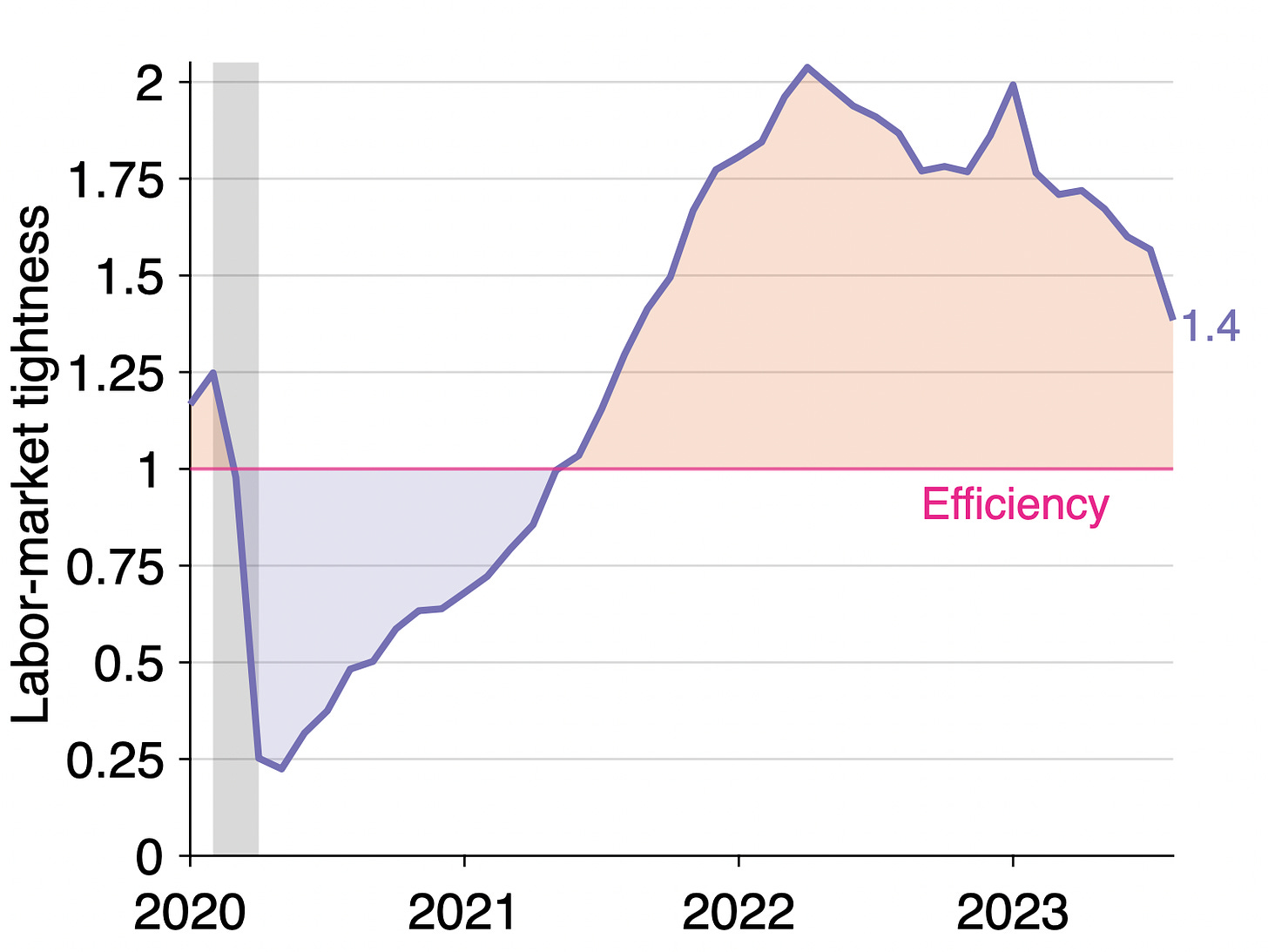

US labor-market numbers for August are in. Labor-market tightness falls to 1.4—still above its efficient level of 1, but rapidly getting closer to it.

The US labor-market numbers for August 2023 just came out. This post uses the latest numbers on vacant jobs and unemployed workers from the Bureau of Labor Statistics to compute three key statistics:

Labor-market tightness

Efficient unemployment rate

Unemployment gap

Overall, the US labor market has cooled rapidly in August. While it remains inefficiently tight, it is rapidly inching closer to efficiency.

New developments

The US labor-market statistics for August 2023 are as follows:

Unemployment rate: u = 3.8%. This is up from 3.5% in July.

Vacancy rate: v = 5.3%. This is down from 5.5% in July.

Labor-market tightness: v/u = 5.3/3.8 = 1.4. This is down from 1.6 in July.

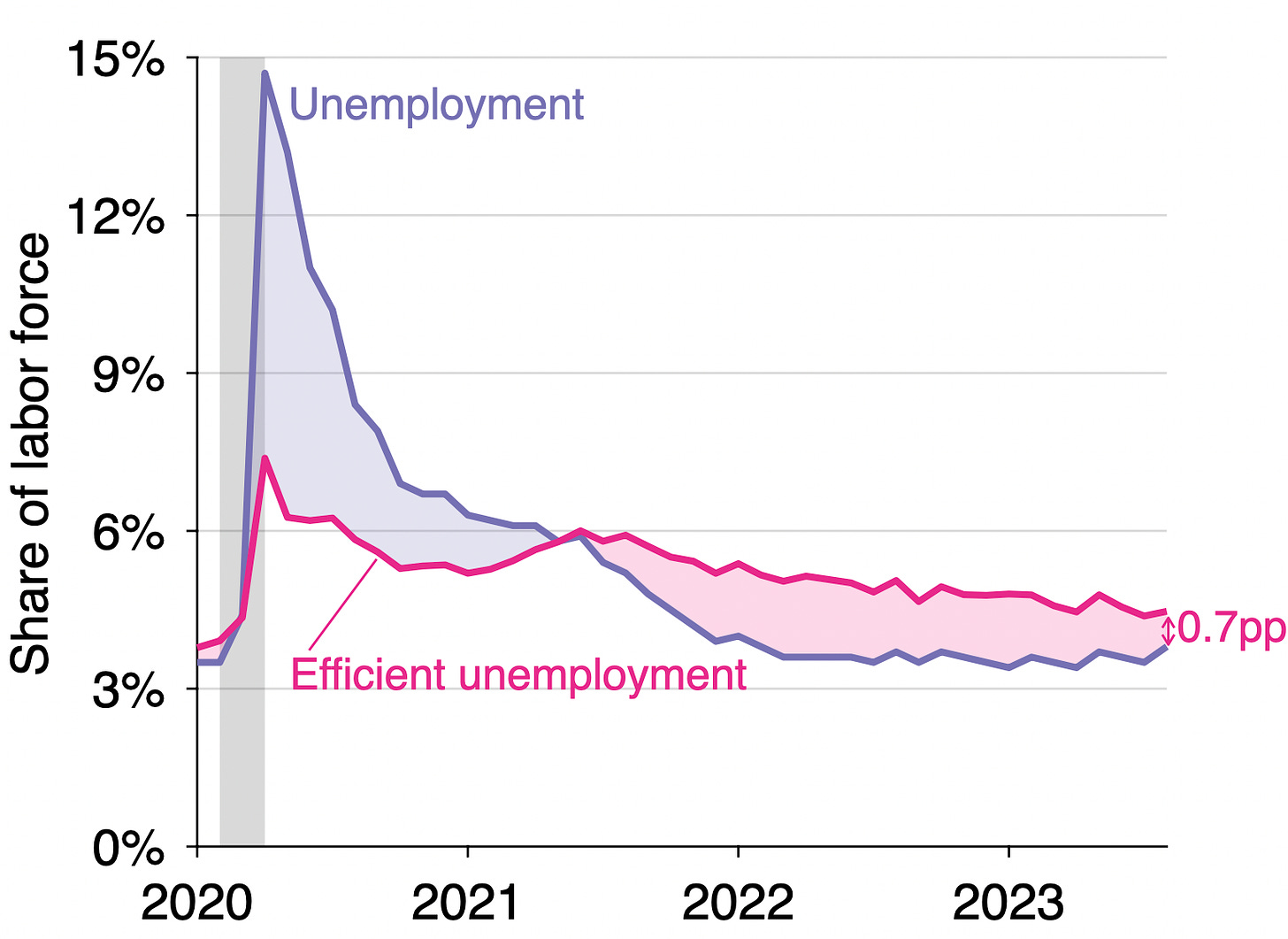

Efficient unemployment rate: u* = √uv = √(0.038 × 0.053) = 4.5%. This is up from 4.4% in July.

Unemployment gap: u – u* = 0.038 – 0.045 = –0.7pp. The gap narrowed from -0.9pp in July.

Is the US labor market is too tight or too slack?

Since the vacancy rate is above the unemployment rate (5.3% > 3.8%), the US labor market remains inefficiently tight. This means that the labor market is above full employment: the labor market is so hot that an excessive amount of labor is devoted to recruiting and hiring instead of producing.1

In fact, the labor market has been inefficiently tight since May 2021, as illustrated below:

We can also see that the US labor market is inefficiently tight by looking at labor-market tightness v/u, which remains above unity (1.4 > 1):

As the above graph shows, however, the labor market is cooling rapidly in the past few months. Tightness has dropped from 2.0 in January 2023 to 1.4 in August. So about two thirds of the tightness gap have been eliminated in the last 8 months.

How far is unemployment from its efficient rate?

Tightness remains above 1, so the labor market is still inefficiently tight. This means that the actual unemployment rate remains below the efficient unemployment rate. The graph below illustrates the construction of the efficient unemployment rate:

In August the efficient unemployment rate is 0.7 percentage point above the actual unemployment rate (u* = 4.5% while u = 3.8%). This negative unemployment gap is another manifestation of an inefficiently tight labor market.

Below is the evolution of the unemployment gap over the course of the pandemic. The unemployment gap has been negative (u* > u) since the middle of 2021. But it is shrinking now:

The efficiency unemployment rate u* indicates the unemployment rate consistent with full employment. Since one of the mandates of the Federal Reserve is to maintain the economy at full employment, u* is a good target for the Fed. When the actual unemployment rate reaches u*, the Fed knows that it has satisfied its employment mandate. Currently unemployment is below u*, so the labor market needs to cool a little more to reach full employment.

At this pace, when will the labor market reach efficiency?

The labor market cooled and moved closer to efficiency in August. How long might it take for the labor market to reach efficiency? In the 8 months between January 2023 and August 2023, tightness fell by 0.6 form 2.0 to 1.4. If tightness continues falling at this speed, it should reach unity in 8 / 0.6 * 0.4 = 5 more months. That is, the labor market might reach efficiency in January 2024.

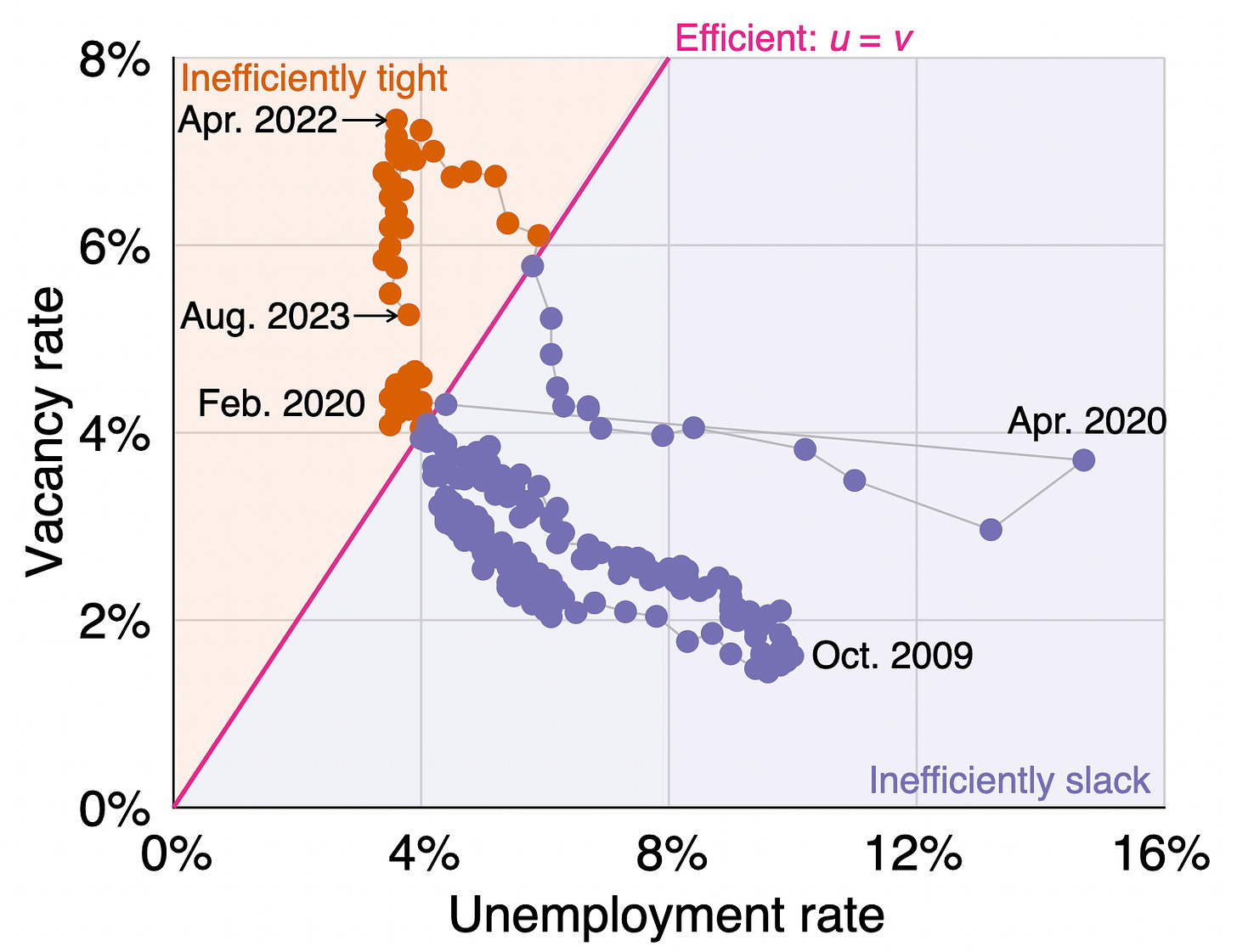

What is happening to the Beveridge curve?

The Beveridge curve dramatically shifted outward at the onset of the pandemic. A soft landing by the Federal Reserve can only occur if the Beveridge curve shifts back inward to its pre-pandemic location. Such shifts do not occur very often, but the curve is currently between its pre-pandemic and pandemic locations, so a shift might be in progress. Let’s continue to keep an eye on the Beveridge curve to see whether a soft landing materializes. Below is the current location of the US labor market in the Beveridge diagram. It falls in-between the pandemic and pre-pandemic curves:

Background for readers just joining us: data

The number of vacant jobs is measured by the Job Openings and Labor Turnover Survey (JOLTS). The number of unemployed workers is measured by the Current Population Survey (CPS). The CPS also reports the number of labor-force participants. These numbers then give unemployment and vacancy rates:

Unemployment rate = # unemployed workers / # labor-force participants

Vacancy rate = # vacant jobs / # labor-force participants

Background for readers just joining us: methodology

The formula u* = √uv for the efficient unemployment rate is derived in a recent paper that Emmanuel Saez and I wrote. The paper shows that under simple but realistic assumptions, the efficient unemployment rate is the geometric average of the unemployment and vacancy rates—that is, u* = √uv.

An implication of this formula is that the labor market is efficient whenever there are as many unemployed workers as vacant jobs (u = v); inefficiently tight whenever there are fewer unemployed workers than vacant jobs (u < v); and inefficiently slack whenever there are more unemployed workers than vacant jobs (u > v). This criterion can also be formulated using labor-market tightness v/u.

The figures in this post are updated versions of those in the paper.

Note that this definition of efficiency and full employment has nothing to do with inflation: it is only about the appropriate allocation of resources on the labor market.