How Should the Fed Respond to Unemployment Fluctuations?

This week's lecture material from ECON2800–Economic Slack.

There is always some slack in the economy. Sometimes there is far too much of it—for instance during the Great Recession— and sometimes there is too little of it—in the aftermath of the coronavirus pandemic for instance. I am currently teaching a PhD course on the topic at Brown University. Lecture videos, notes, and readings are publicly available. Today’s post provides a brief overview of the material covered this week. The topic for the week is “Optimal Monetary Policy Over the Business Cycle”.

Overview of this week’s material

Last week we compared the efficient unemployment rate to the actual unemployment rate in the United States. We found that the US labor market is generally inefficiently slack, and especially exceedingly slack in slumps. That is, the unemployment gap is generally positive and especially large in slumps.

At the same time, monetary policy influences aggregate demand, so it can be used to shrink the unemployment gap. In fact, in a broad class of models—the divine Beveridge-Wicksell models—the optimal monetary policy is to adjust interest rates to eliminate the unemployment gap entirely. So the Fed should lower rates in bad times, when unemployment is inefficiently high, and raise rates in good times, when unemployment is inefficiently low.

This week we derive a sufficient-statistic formula for optimal monetary policy. The formula gives the optimal interest rate as a function of the current interest rate, current unemployment gap, and the monetary multiplier—the response of the unemployment rate to interest rates. We apply the formula to a two recent episodes: Great Recession and coronavirus pandemic.

Breakdown of this week’s lecture videos

This week’s first lecture video provides a quick introduction to divine Beveridge-Wicksell models. The optimal monetary-policy formula will apply to any model in this class. These models share three features:

A Beveridge curve generating unemployment

Divine coincidence so inflation is on target when unemployment is efficient

The Wicksellian property that the nominal interest rate controls aggregate activity

The second video computes the sufficient-statistic formula for optimal monetary policy. The formula says that the optimal nominal interest rate eliminates the unemployment gap. The formula involves only two sufficient statistics: the unemployment gap (u–u*) and the monetary multiplier (du/di).

The third video then provides estimates of the monetary multiplier in the United States. Broadly, it seems that the unemployment rate increases by 0.5 percentage point when the nominal interest rate rises by 1 percentage point.

The fourth video then describes the optimal response of monetary policy to unemployment fluctuations. A good rule of thumb is that the Fed should lower interest rates by 2 percentage points whenever the unemployment rate increases by 1 percentage point.

This rule of thumb seems close to what the Fed does in practice, as we show in the fifth video. It also explains why the zero lower bound became so quickly binding at the onset of the Great Recession. The unemployment gap at the peak of the Great Recession reached more than 5 percentage points, so the Fed should have lowered rates by more than 10 percentage points to eliminate the gap. But the fed funds rate in 2007 was only 5.25%. The Fed did not have enough room to lower its rate by 10 percentage points without hitting the zero lower bound.

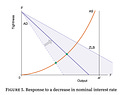

In the sixth video we show that the dynamic model of slack covered earlier in the course is a divine Beveridge-Wicksell model. The sufficient-statistic formula derived this week therefore applies to that model. The video also illustrates the effect of monetary policy on unemployment in an AD-AS diagram.

A key sufficient statistic to determine the efficient unemployment rate u* is the elasticity of the Beveridge curve. The seventh video computes the Beveridge curve and its elasticity in the dynamic model. It shows that when the matching elasticity takes a standard value of 0.5, then the Beveridge elasticity is about 1, so that the formula u* = √uv applies to the model.

Of course, one important constraint on monetary policy is that the nominal interest rate cannot become negative: it faces a zero lower bound. However, as the last video shows, a wealth tax can perfectly replace monetary policy. Indeed, an increase in the wealth tax rate deters saving and promotes consumption just like a reduction in the nominal interest rate. So implementing a wealth tax at the zero lower bound might help reduce unemployment.

This week’s readings

This week’s analysis of monetary policy follows a recent paper that Emmanuel Saez and I wrote. The paper is titled “An Economical Business-Cycle Model.” It builds a simple model of how monetary policy influences unemployment. The paper also derives the sufficient-statistic formula for optimal monetary policy, and reviews estimates of the sufficient statistics (unemployment gap & monetary multiplier) for the United States.

To apply the optimal monetary policy formula to the United States, we use empirical results provided by several papers. “The Federal Funds Rate and the Channels of Monetary Transmission” by Ben Bernanke and Alan Blinder uses VAR to obtain an estimate of the monetary multiplier. It also shows that the federal funds rate systematically drops when the unemployment rate rises—in line with what our formula suggests the Fed should do.

We also use the results from “Are the Effects of Monetary Policy Shocks Big or Small?” by Olivier Coibion. That paper blends VAR and narrative approaches to measure the effects of monetary policy and estimate the monetary multiplier.

Finally, “Okun's Law: Fit at 50?” by Larry Ball, Daniel Leigh, and Prakash Loungani shows that output and unemployment rate are negatively correlated (Okun's law). Through the lens of our model of slack, this finding implies that aggregate-demand shocks must be a major source of business cycles. Since monetary policy controls aggregate demand, we expect it to be able to stabilize business cycles well.

Plan for next week

Sometimes monetary policy is unavailable to eliminate the unemployment gap. At the zero lower bound on nominal interest rates, for instance, conventional monetary policy cannot be used to stabilize the economy. For countries who are part of a monetary union, such as countries of the Eurozone, monetary policy is not available either. In such cases, fiscal policy can help reduce the unemployment gap. Next week we will discuss how fiscal policy should respond to fluctuations in unemployment when monetary policy is unavailable.