All Quiet on the Labor-Market Front

US labor-market numbers are almost unchanged in July. Tightness remains at 1.6—above its efficient level of 1.

The US labor-market numbers for July 2023 came out recently. This post uses the latest numbers on vacant jobs and unemployed workers from the Bureau of Labor Statistics to compute three key statistics:

Labor-market tightness

Efficient unemployment rate

Unemployment gap

Almost nothing has changed in July 2023 compared to June 2023, so this post will be short. Readers who are interested in a longer discussion of the state of the labor market, and the recent behavior of inflation, can have a look at the June post.

New developments

The US statistics for July 2023 are as follows:

Unemployment rate: u = 3.5%. This is down from 3.6% in June 2023.

Vacancy rate: v = 5.7%. This is down from 5.8% in June 2023.

Labor-market tightness: v/u = 5.7/3.5 = 1.6. This is the same as in June 2023.

Efficient unemployment rate: u* = √uv = √(0.035 × 0.057) = 4.5%. This is down from 4.6% in June 2023.

Unemployment gap: u – u* = 0.035 – 0.045 = –1.0pp. The gap is the same as in June 2023.

Is the US labor market is too tight or too slack?

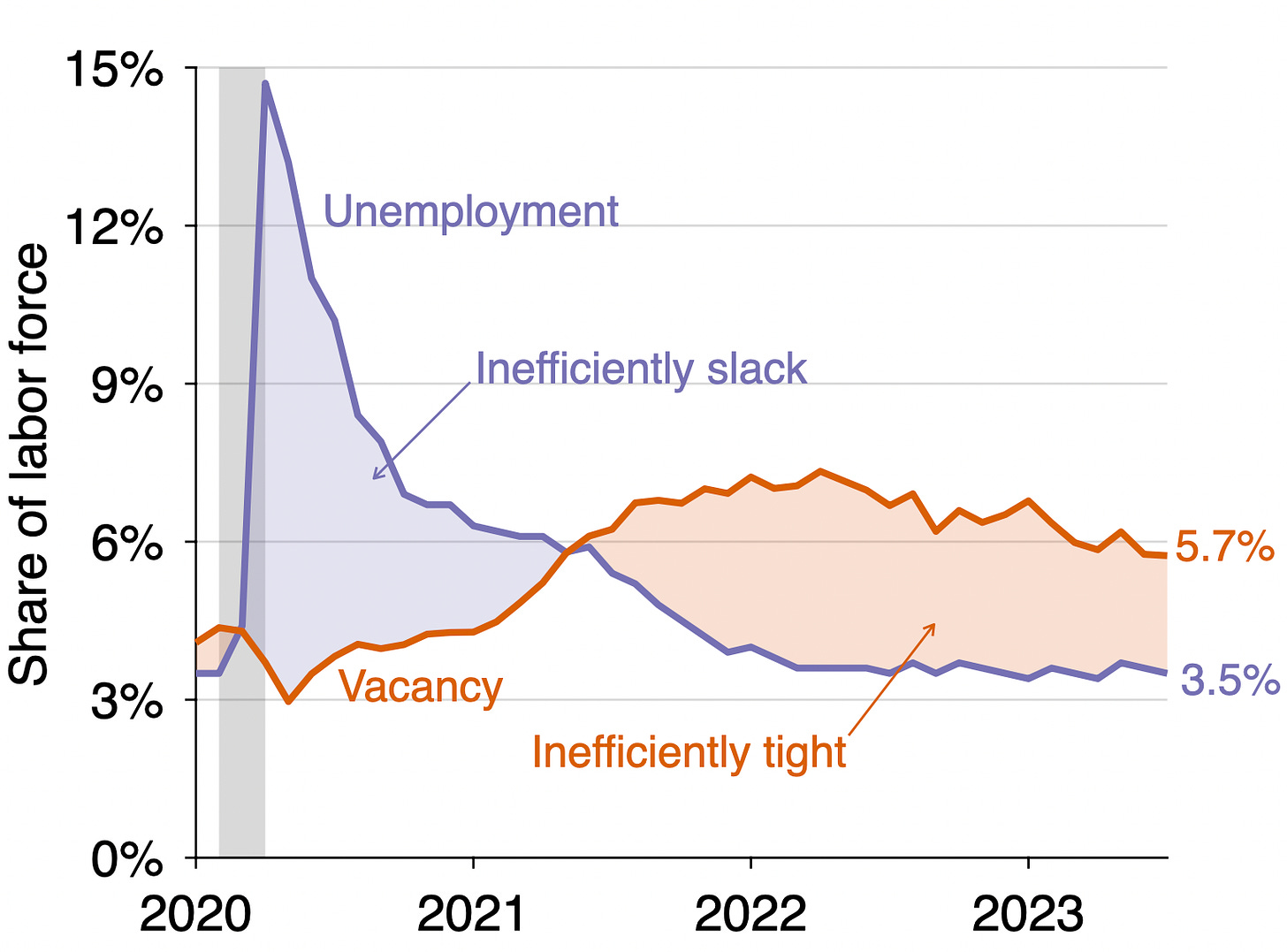

Since the vacancy rate is above the unemployment rate (5.7% > 3.5%), the US labor market remains inefficiently tight. The labor market has been inefficiently tight since May 2021, as illustrated below:

We can also see that the US labor market is inefficiently tight by looking at labor-market tightness v/u, which remains above unity (1.6 > 1):

How far is unemployment from its efficient rate?

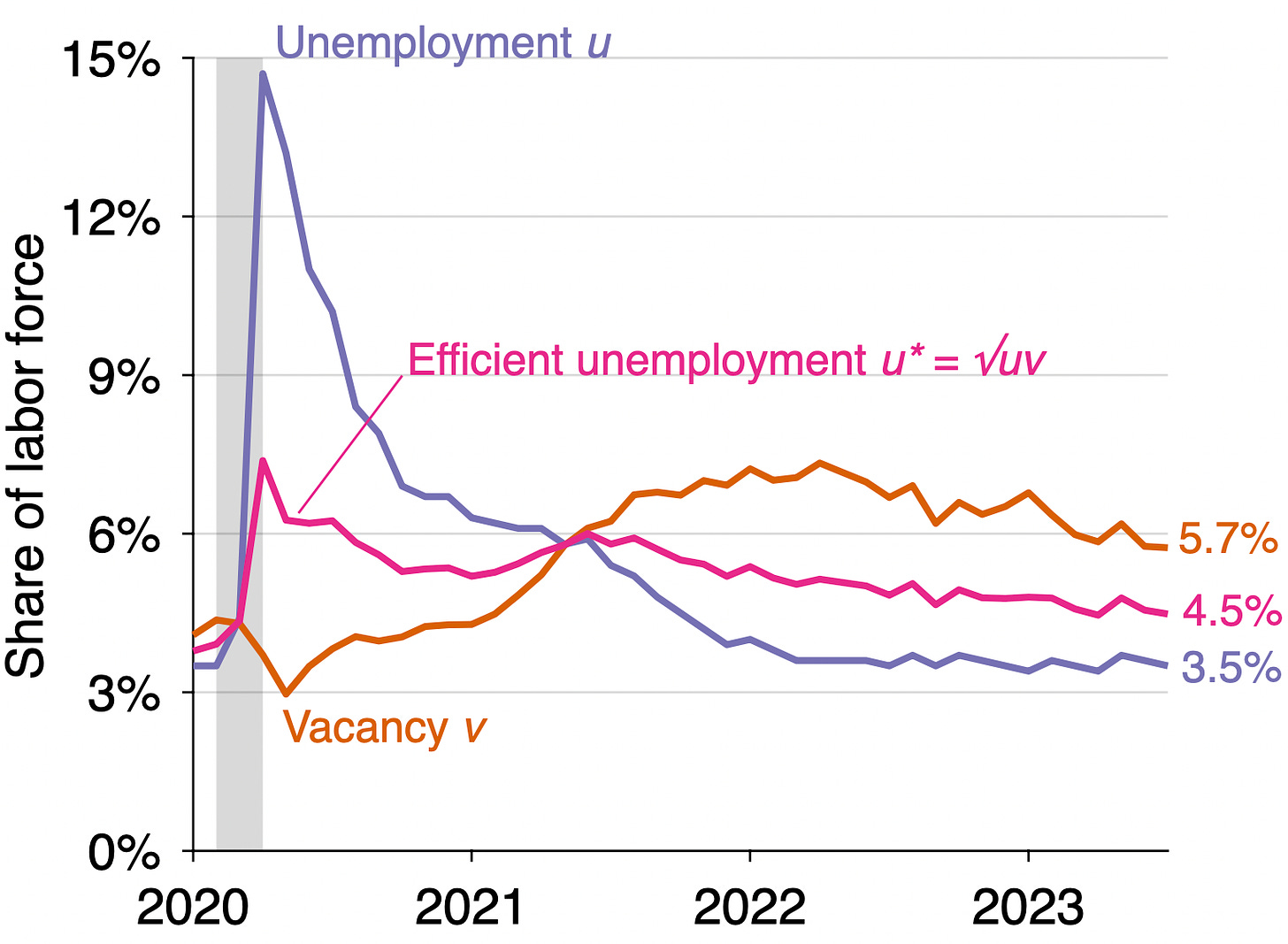

Tightness did not change in July. It remains above 1, so the labor market is still inefficiently tight. This means that the actual unemployment rate remains below the efficient unemployment rate. The graph below illustrates the construction of the efficient unemployment rate:

In July 2023 the efficient unemployment rate is 1 percentage point above the actual unemployment rate (u* = 4.5% while u = 3.5%). This negative unemployment gap is another manifestation of an inefficiently tight labor market.

Below is the evolution of the unemployment gap over the course of the pandemic. The unemployment gap has been negative (u* > u) since the middle of 2021:

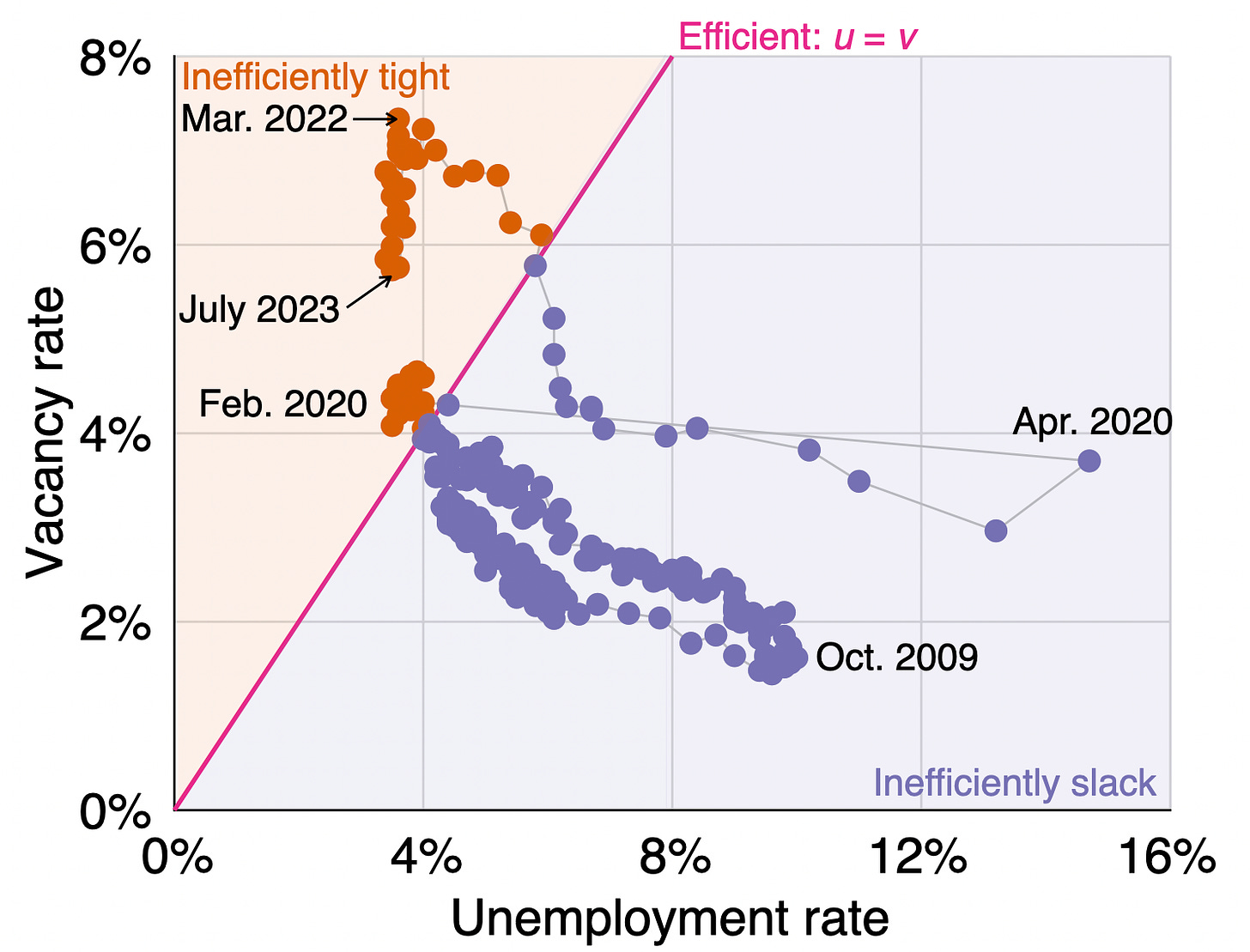

What is happening to the Beveridge curve?

The Beveridge curve dramatically shifted outward at the onset of the pandemic. A soft landing by the Federal Reserve can only occur if the Beveridge curve shifts back inward to its pre-pandemic location. Such shifts do not occur very often, but the curve is currently between its pre-pandemic and pandemic locations, so a shift might be in progress. Let’s continue to keep an eye on the Beveridge curve to see whether a soft landing materializes. Below is the current location of the US labor market in the Beveridge diagram. It falls in-between the pandemic and pre-pandemic curves:

Background for readers just joining us: data

The number of vacant jobs is measured by the Job Openings and Labor Turnover Survey (JOLTS). The number of unemployed workers is measured by the Current Population Survey (CPS). The CPS also reports the number of labor-force participants. These numbers then give unemployment and vacancy rates:

Unemployment rate = # unemployed workers / # labor-force participants

Vacancy rate = # vacant jobs / # labor-force participants

Background for readers just joining us: methodology

The formula u* = √uv for the efficient unemployment rate is derived in a recent paper that Emmanuel Saez and I wrote. The paper shows that under simple but realistic assumptions, the efficient unemployment rate is the geometric average of the unemployment and vacancy rates—that is, u* = √uv.

An implication of this formula is that the labor market is efficient whenever there are as many unemployed workers as vacant jobs (u = v); inefficiently tight whenever there are fewer unemployed workers than vacant jobs (u < v); and inefficiently slack whenever there are more unemployed workers than vacant jobs (u > v). This criterion can also be formulated using labor-market tightness v/u.

The figures in this post are updated versions of those in the paper.