August Labor-Market Update

The US labor market is now cooler than in 2019, and it approaches full employment. The probability that the US economy has entered a recession creeps up to 48%.

Main message: US labor-market tightness falls slightly to 1.08 in August 2024. The US labor market is now cooler than in 2019, and is getting ever closer to full employment. The probability that the US economy is in recession creeps up to 48%.

The US labor-market data for August 2024 just came out. This post uses the latest numbers on vacant jobs and unemployed workers from the Bureau of Labor Statistics to compute labor-market tightness, full-employment rate of unemployment (FERU), unemployment gap, and recession probability.

New developments

The US labor-market statistics for August 2024 are as follows:

Unemployment rate: u = 4.2%. This is down from 4.3% in July.

Vacancy rate: v = 4.6%. This is down from 4.9% in July.

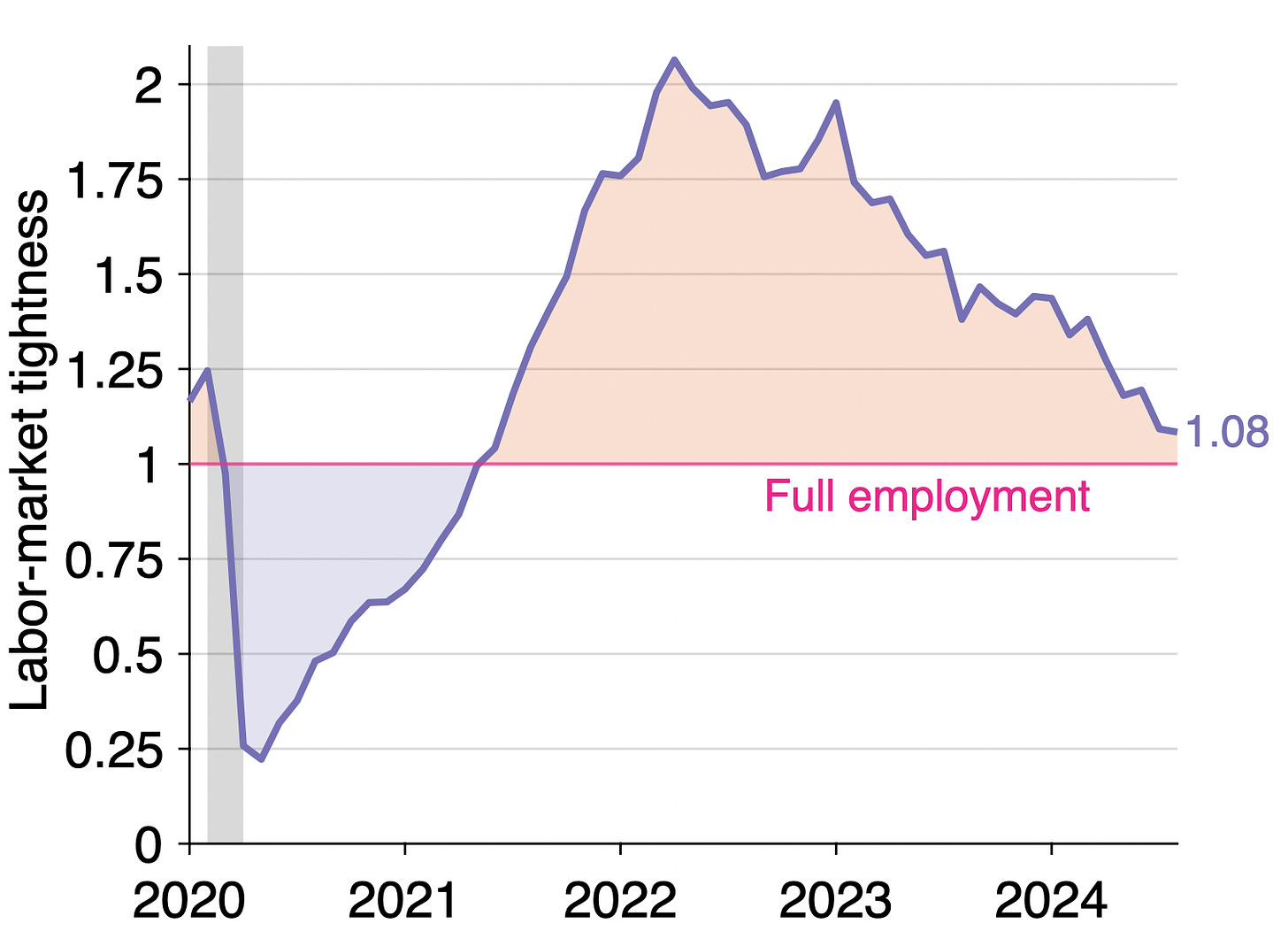

Labor-market tightness: v/u = 4.6/4.2 = 1.08. This is down from 1.09 in July.

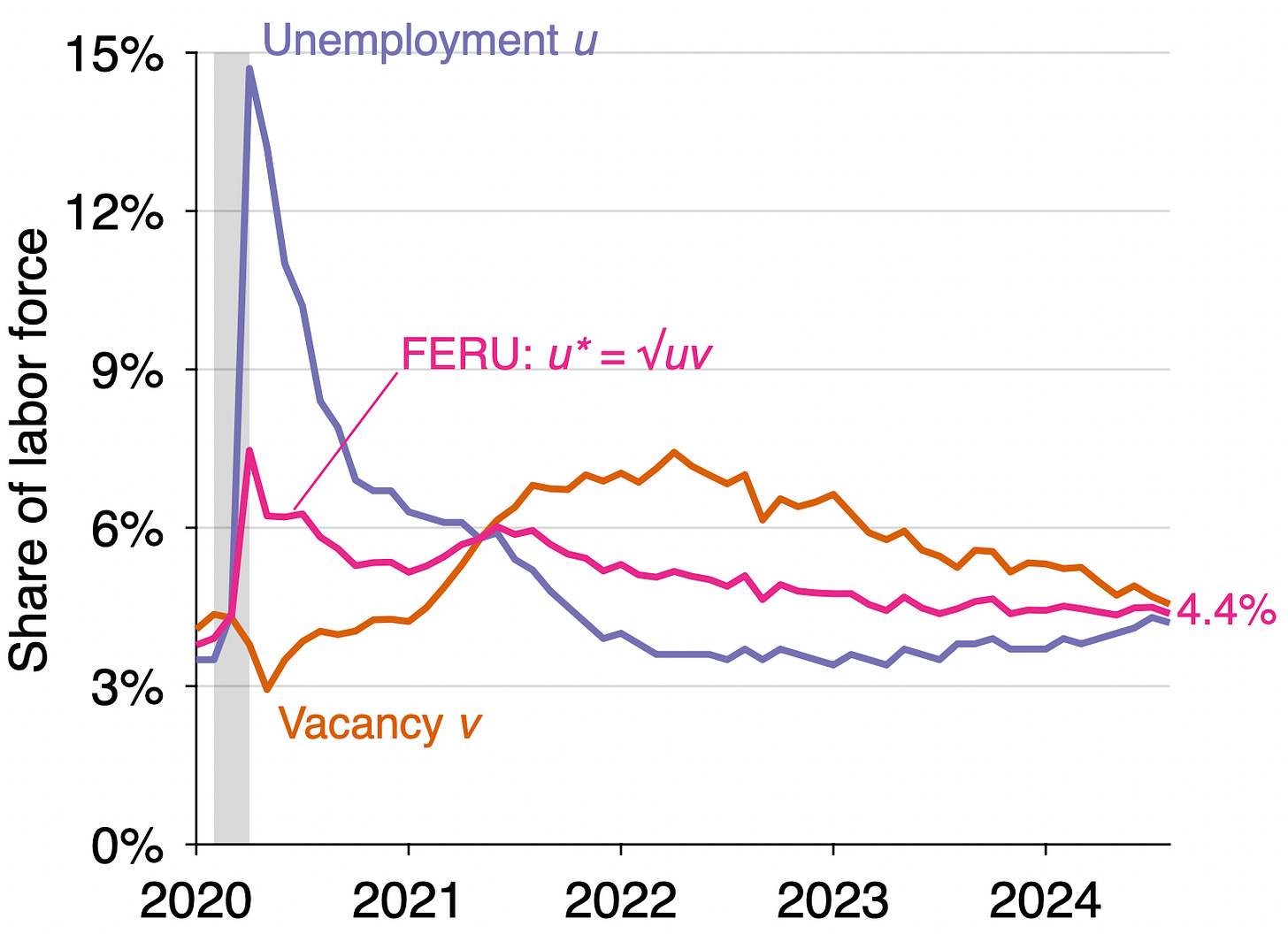

FERU: u* = √uv = √(0.042 × 0.046) = 4.4%. This is down from 4.6% in July.

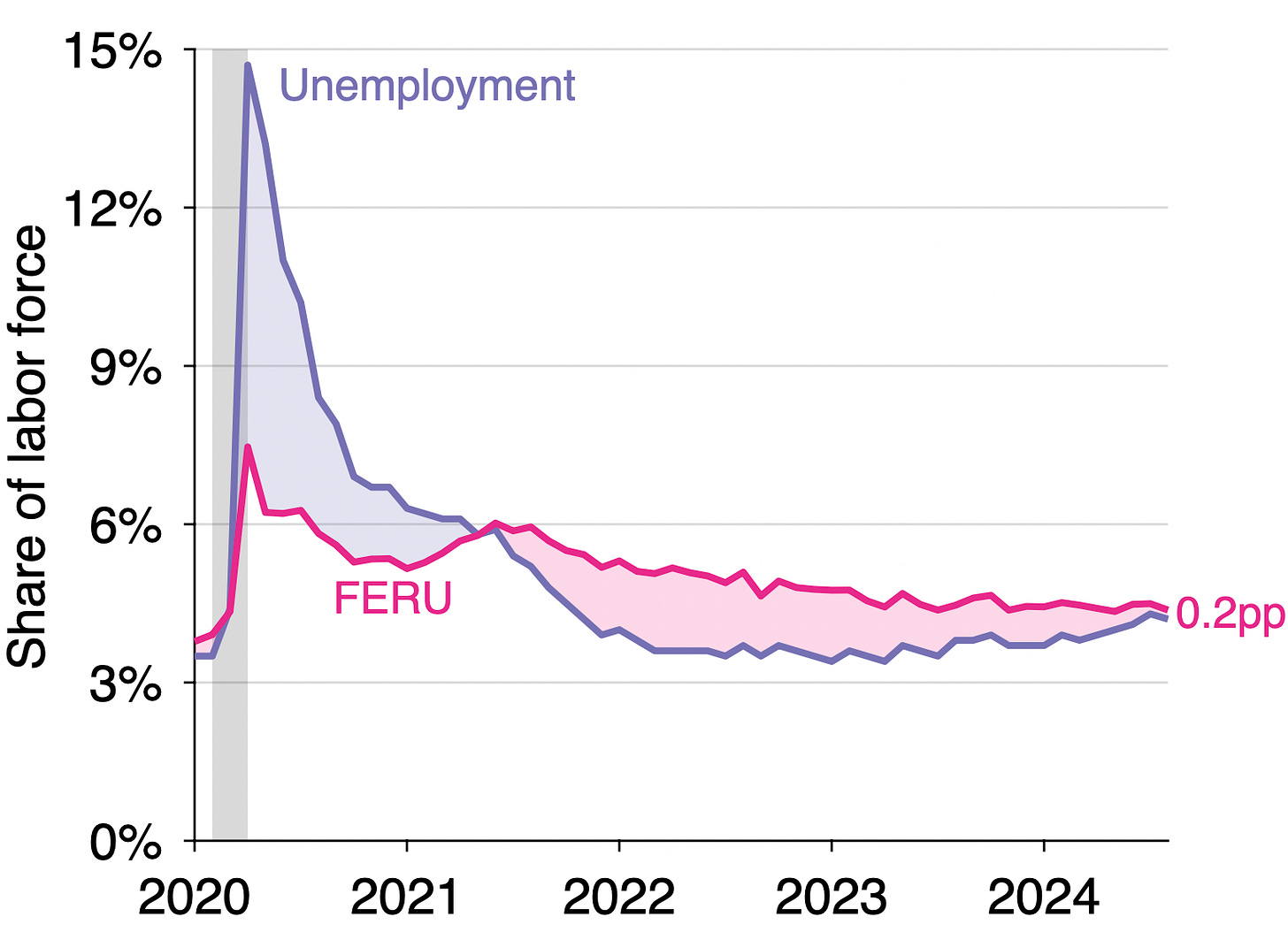

Unemployment gap: u – u* = 0.042 – 0.044 = –0.2pp. The gap shrank from -0.03pp in July.

Recession indicator = 0.54pp. This is up from 0.49pp in July.

Recession probability = (0.54-0.3)/(0.8-0.3) = 48%. This is up from 38% in July.

Background for readers just joining us

The FERU formula u* = √uv is derived in a paper with Emmanuel Saez. The formula implies that the labor market is at full employment when there are as many unemployed workers as vacant jobs (u = v); inefficiently tight when there are fewer unemployed workers than vacant jobs (u < v); and inefficiently slack when there are more unemployed workers than vacant jobs (u > v). Data and results for the paper are available on GitHub.

The recession indicator and recession probability are developed in new work with Emmanuel. The recession indicator combines data on job vacancies and unemployment. The indicator is the minimum of the Sahm indicator—the difference between the 3-month trailing average of the unemployment rate and its minimum over the past 12 months—and a similar indicator constructed with the vacancy rate—the difference between the 3-month trailing average of the vacancy rate and its maximum over the past 12 months. When the indicator reaches 0.3pp, a recession may have started; when the indicator reaches 0.8pp, a recession has started for sure. The raw data used in this note are also available on GitHub.

Is the US labor market too tight or too slack now?

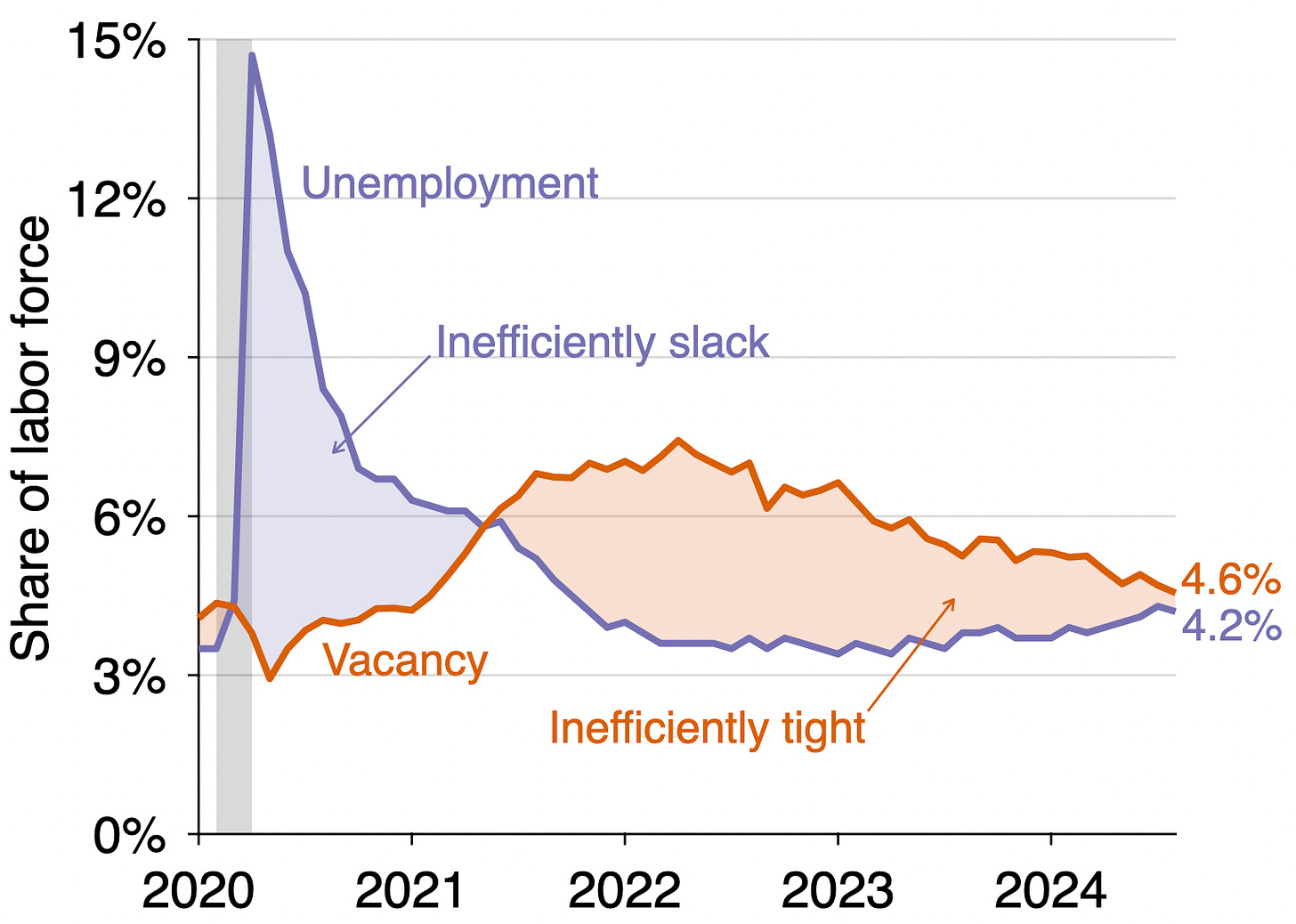

Coming back to the August 2024 situation, we see that the vacancy rate is above the unemployment rate (4.6% > 4.2%), so the US labor market remains inefficiently tight. The labor market has been inefficiently tight since May 2021:

We can also see that the US labor market is inefficiently tight by looking at labor-market tightness v/u. Tightness remains above unity (1.1 > 1), which signals that the labor market is inefficiently hot. However, we can clearly see that the labor market is now approaching full employment. At this pace, the labor market should reach full employment in the next few months:

Labor-market tightness has also now fallen below its pre-pandemic level (it hovered around 1.2 in 2019 and early 2020). So the post-pandemic overheating is now gone.

How far is unemployment from the FERU?

Since the labor market is inefficiently tight, the actual unemployment rate remains below the FERU. The graph below illustrates the construction of the FERU:

The FERU is 0.2 percentage point above the actual unemployment rate (u = 4.2%, u* = 4.4%). This negative unemployment gap is another manifestation of an inefficiently tight labor market. Below is the evolution of the unemployment gap over the course of the pandemic. The unemployment gap has been negative (u* > u) since the middle of 2021, but is now shrinking to zero:

Given how much the labor market cooled, have we entered a recession?

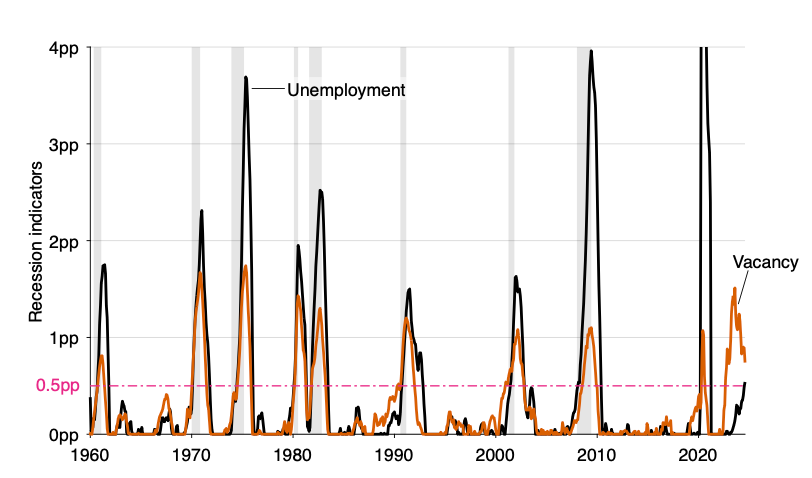

Our indicator is the minimum of the Sahm indicator, which is built from the unemployment rate, and a similar indicator built with the vacancy rate. Below is the standard Sahm indicator (black line) and the threshold of 0.5pp that is used in the Sahm rule. The Sahm indicator is the difference between the 3-month trailing average of the unemployment rate (plotted above) and its minimum over the past 12 months. The Sahm rule says that a recession might have started whenever the unemployment indicator crosses the threshold of 0.5pp. The Sahm rule has been triggered for the first time this month (the indicator reached 0.54pp>0.5pp), so according to it, the US economy has entered a recession:

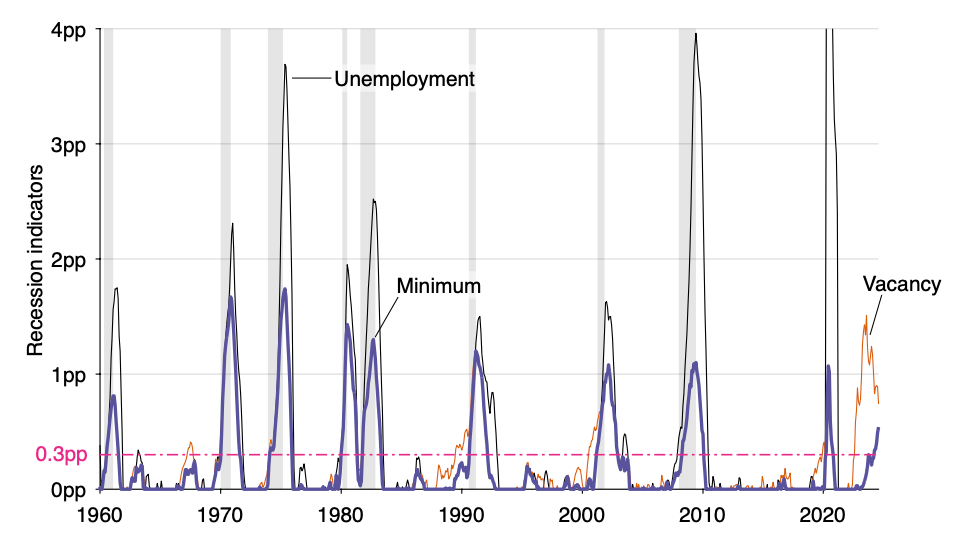

But we can also construct the same type of indicator with the vacancy rate (orange line above). Indeed, job vacancies start falling quickly at the onset of recessions, when unemployment starts rising. Requiring that both rise gives a more accurate and—maybe counterintuitively—more rapid recession signal. Here is the indicator that we build, the minimum of the unemployment and vacancy indicators:

Because this minimum indicator is less noisy that either the unemployment or the vacancy indicator, we can lower the recession threshold from 0.5pp to 0.3pp and detect recessions faster. Our minimum indicator reached 0.3pp between March and April 2024, so the recession might have started then. The current value of the minimum indicator is 0.54pp > 0.3pp.

What is the probability that we are now in recession?

A one-sided recession rule such as the Sahm rule tells us whether a recession might have started. To know what is the likelihood that a recession has started, we propose a two-sided recession rule.

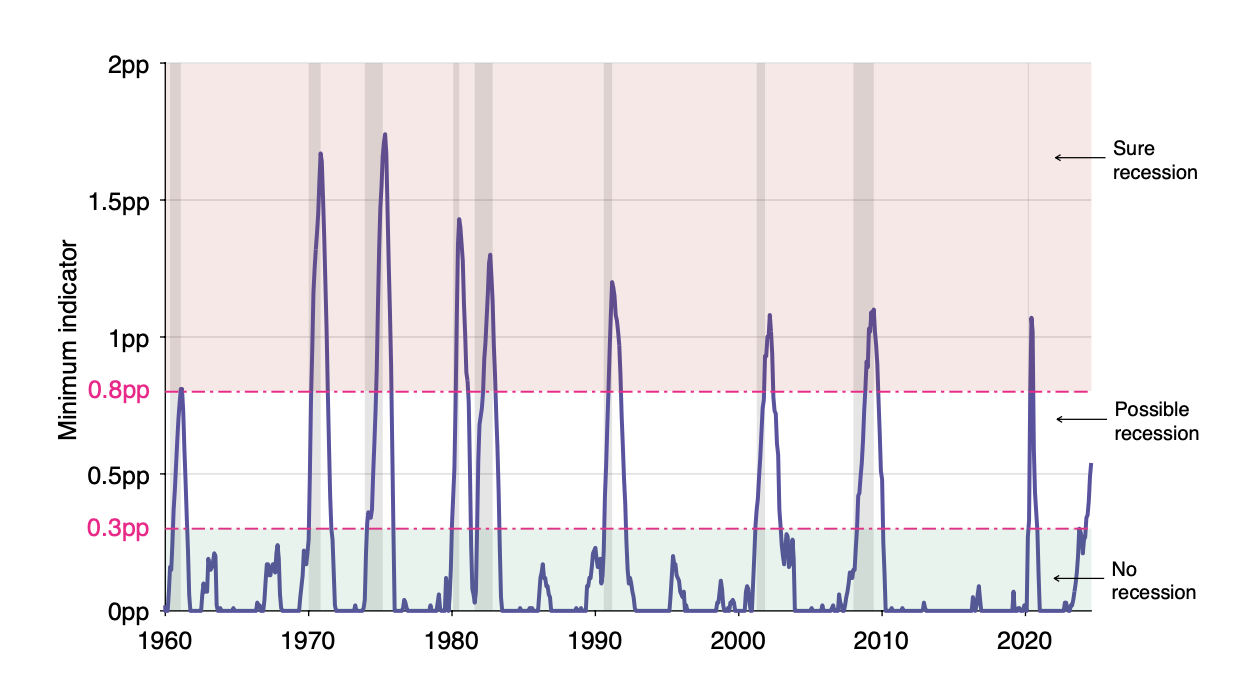

The bottom threshold is the lowest value that generates no false positives over 1960–2022 (this is how the threshold of 0.5pp is determined in the Sahm rule). A false positive is when the rule predicts a recession that does not materialize. This bottom threshold is 0.3pp.

The top threshold is the highest value that generates no false negatives over 1960–2022. A false negative is when the rule does not catch an actual recession. This top threshold is 0.8pp.

The rule therefore says the following. When the minimum indicator is below 0.3pp, the recession has not started. When the minimum indicator is between 0.3pp and 0.8pp, the recession might have started. And when the minimum indicator is above 0.8pp, the recession has started for sure. The two-sided rule can be illustrated as follows:

With August 2024 data, the minimum indicator is at 0.54pp, so the probability that the US economy is now in recession is (0.54-0.3)/(0.8-0.3) = 48%. This probability captures the fact that we do not know exactly what is the threshold between a recession and a non-recession. From historical data, we learn that the true threshold is somewhere between 0.3pp and 0.8pp. The recession probability captures the share of the threshold range that has been covered.